Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

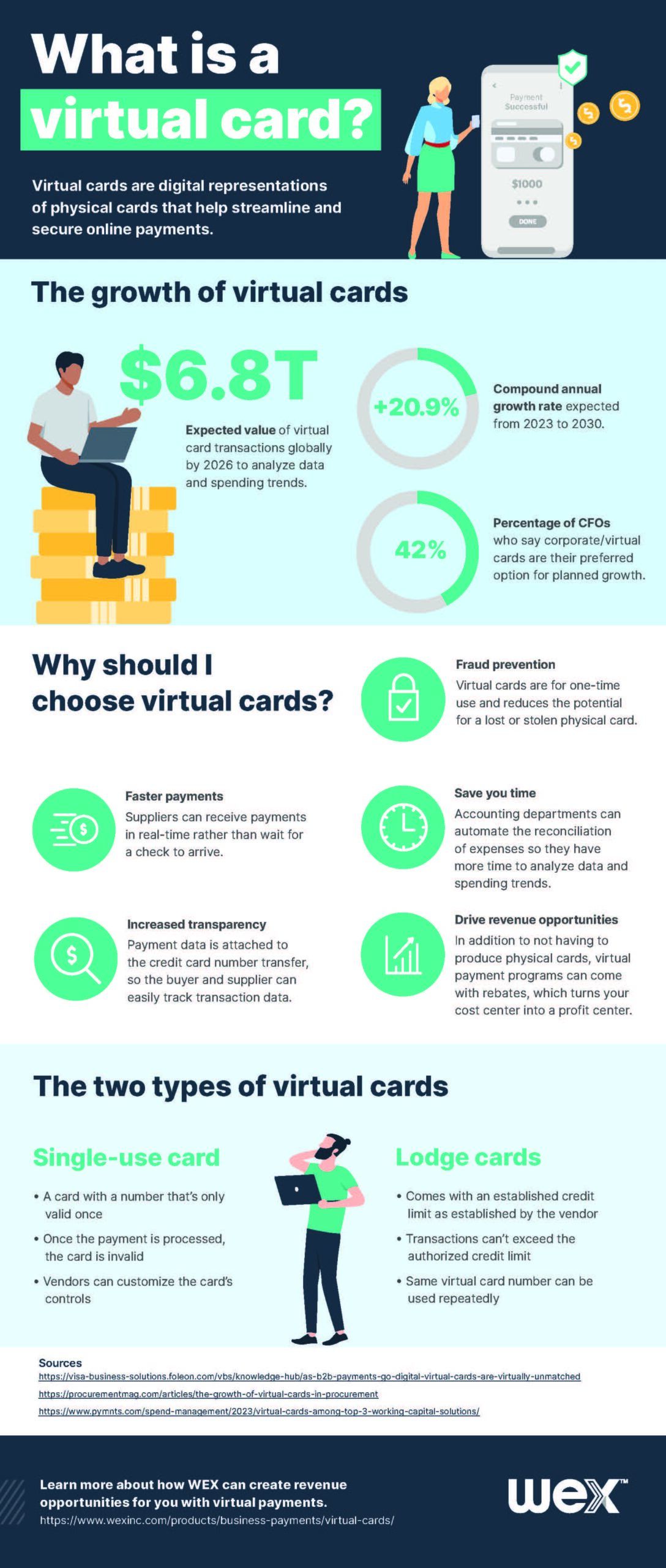

Ghost cards and virtual cards allow you to make payments without depending on a physical card. Let’s explore ghost cards and virtual cards to help you decide which payment method can benefit your business the most.

No. While they operate very similarly (during the point of purchase and from a supplier standpoint), they have different characteristics that influence the benefits your business receives.

Virtual cards are digital-only versions of credit cards. They are a touchless form of payment that is typically issued for single use, so you receive a unique card number, expiration date, and CVV with each virtual card.

Virtual cards rely on a fully integrated experience with your ERP (enterprise resource planning) software. By setting this up, you are automating the card creation and processing experience for your accounts payable team, which saves them time.

Ghost cards (also referred to as lodge cards) are also a digital-only type of card that’s easy to get up and running quickly. Like a virtual card, a ghost card exists as digital-only, so you don’t need to wait for physical credit cards to be processed and sent by your card provider before you can start making payments.

With a ghost card, you typically receive card numbers, security codes, and expiration dates that don’t change. These types of cards can be used repeatedly to make payments (unlike virtual cards).

Choosing between ghost cards and virtual cards ultimately depends on your specific needs and preferences. Virtual cards come with perks that ghost cards don’t have. But ghost cards can provide an opportunity for you to quickly transition to digital payments until your virtual card program is ready.

Choose a virtual card provider that has the pricing, service, and relationships to help you build out the payment experience that’s right for you.

For more insights and updates on corporate payments, check out:

Learn more about how WEX payment solutions can be tailored to your business, so you can accelerate and streamline operations while creating lasting growth and success for your organization.

Stay up to date on the latest in business payments by subscribing to our blog! Simply hit the “Subscribe” button above or submit your email address in the form below.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax, and investment advisers.

Editorial note: This article was originally published on May 9, 2024, and has been updated for this publication.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.