Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Most employees are about to have the opportunity to re-evaluate their benefits options during open enrollment. Flexible spending accounts (FSAs) are a powerful tool for individuals and employers to save money on healthcare and dependent care expenses. However, despite the numerous advantages, some employees remain hesitant to embrace this valuable resource. So why are many employees reluctant to participate in FSAs? Let’s take a look.

The concern: Some individuals may not fully comprehend how an FSA works and may be hesitant to enroll due to confusion or uncertainty about its benefits and limitations.

What you can do: Education is key. Provide clear, concise resources that explain the ins and outs of FSAs. Empower your employees with helpful resources that answer many of their lingering questions, including our blog, benefits toolkit, and knowledgebase of FSA-related videos and educational materials. Break down the process of contributing to an FSA, eligible expenses, and the reimbursement process. Participants want fast reimbursement of claims, and technology and automation can give them that. For example, with WEX, they can use:

The concern: FSAs are subject to a “use-or-lose” rule, meaning any unused funds at the end of the plan year are forfeited. This can deter people from enrolling, especially when they are concerned about losing money they contribute to the FSA but don’t end up using.

What you can do: Ease this fear by highlighting the ways to avoid losing funds. Encourage employees to plan their expenses carefully and regularly log in to their online account or mobile app to track spending and balances. Additionally, adding a carryover or grace period to your FSA reduces the year-end risk for your employees. Here’s how they work:

The concern: Contributing to an FSA requires setting aside a portion of one’s income throughout the year. Some individuals may be wary of reducing their take-home pay, especially if they are already on a tight budget.

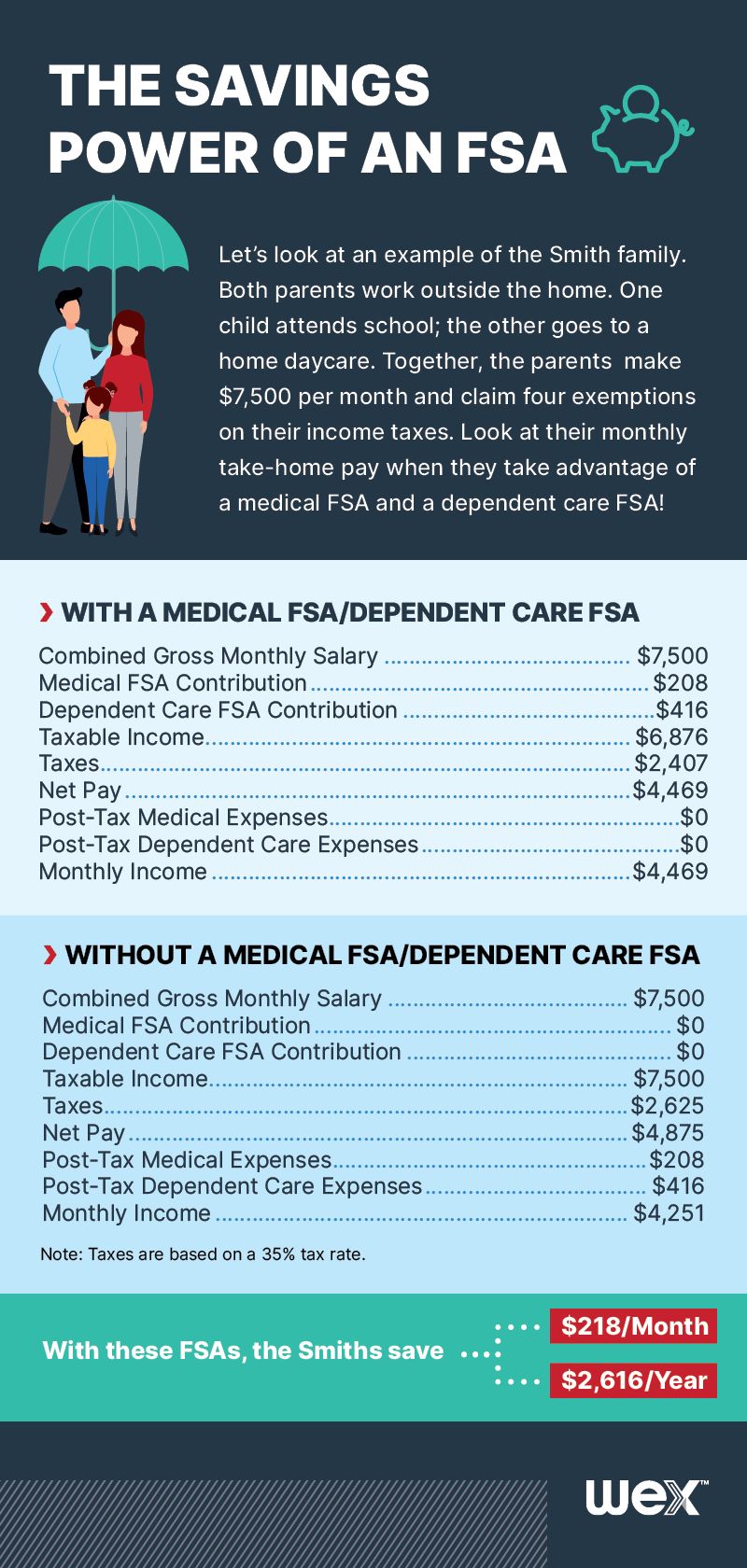

What you can do: Address this concern by emphasizing the savings potential of an FSA. Illustrate how pre-tax contributions lead to significant savings over time, effectively reducing the impact on take-home pay. There are also many daily expenses that an FSA can cover, such as prescription medication and over-the-counter medicines (sometimes a doctor’s prescription is needed to ensure eligibility). Make sure to explain these benefits and emphasize that employees should only spend what they can.

The graphic below is an example of how an FSA will actually increase a participant’s cash flow by showing them how much they’ll save.

The concern: If a person doesn’t anticipate having many eligible medical or dependent care expenses during the year, they may feel that the potential savings from an FSA are not worth the effort of enrollment.

What you can do: Highlight the flexibility of FSAs. Emphasize that eligible expenses encompass a wide range of medical, dental, and vision costs, as well as dependent care expenses. Provide real-world scenarios that showcase the unexpected nature of healthcare expenses, underscoring the importance of being prepared. Consider offering tools that estimate potential savings based on different expense levels, showcasing the value of even minor contributions to an FSA.

The concern: Some individuals might prefer other benefits, such as a health savings account (HSA), lifestyle spending account (LSA) or health reimbursement arrangement (HRA), which they find more attractive or suitable for their needs.

What you can do: While promoting the benefits of an FSA, it’s important to respect individual choices. If employees find that an FSA does not align with their current needs, it’s perfectly fine to explore other options. The key is to empower employees to make informed decisions that work best for them and offer options so they can embrace the power of choice.

Before making a decision, walk through the eligibility requirements of different benefit options. Provide clear comparisons that highlight the unique advantages of each account, such as immediate tax savings with an FSA, or long-term investment potential with an HSA. By offering guidance on eligibility and benefits, you enable employees to make a well-rounded assessment of their options and select the one that truly suits their situation. Remember that the goal is to ensure that each individual’s benefits package is tailored to their specific needs and financial goals.

Want to learn more about how you can support your employees? Check out our employee wellness guide below!

Drive wellness

that works

Get your guide.

The information in this blog post is for educational purposes only. It is not legal, financial, or tax advice. For legal, financial, or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.