Stay connected

Subscribe to our corporate payments blog to stay on top of payment innovations.

Nearly two-thirds of organizations were victims of attempted or actual fraud in 2022. By making changes sooner rather than later, you can protect yourself and your suppliers’ time and money. Here are 5 different ways to reduce the risk of virtual card fraud.

Revolutionizing payment security, virtual cards are an unparalleled deterrent against fraud through innovative features like one-time-use card numbers and tokenization.

Unlike traditional payment methods with static information, virtual cards generate a fresh set of credentials for every payment, rendering stolen data useless for subsequent unauthorized transactions. This significantly reduces the risk of data breaches and reinforces the security of financial transactions.

They also employ tokenization, replacing sensitive payment information with a unique token. Even if intercepted, this tokenized approach ensures the information holds no value for potential fraudsters, as it remains indecipherable, thereby elevating virtual cards to the forefront of payment security.

These are two reasons why digital payments are seven times less susceptible to fraud than check payments.

To learn more about tokenization, watch this video:

Virtual cards empower organizations with enhanced control and security in their financial transactions, particularly in mitigating the risk of fraud. By providing businesses the ability to establish spending limits and customize card usage according to specific needs, virtual cards counteract potential unauthorized or excessive spending that could lead to fraudulent activities.

Organizations can streamline their transactions by creating unique virtual cards designated for specific purposes and predefined amounts for each supplier. This level of customization not only simplifies the payment process but also ensures that funds are allocated precisely as intended, reducing the likelihood of unauthorized transactions. In essence, they provide a dynamic and secure framework for businesses to navigate their financial landscape, offering a proactive approach to managing spending while protecting against potential risks for fraud.

Virtual cards integrate payment data directly into each credit card transfer. Unlike traditional payment methods, where transaction data might be detached or require manual reconciliation, virtual cards automatically embed comprehensive payment information with each transfer. This automation not only expedites the expense reconciliation process but also facilitates a seamless analysis of purchase data. Businesses can effortlessly track and interpret transaction details without the need for extensive manual intervention.

This streamlined approach not only enhances efficiency but also contributes to a more accurate and transparent financial reporting system, empowering organizations to make informed decisions based on real-time, data-driven insights.

Virtual cards offer a nimble solution to the ever-evolving needs of organizations by enabling quick and easy issuance. Unlike traditional physical cards or checks (the top two payment methods subject to fraud), the process of generating a virtual card is fast and efficient. This allows organizations to respond promptly to changing requirements, whether it be adapting to new vendors, managing fluctuating payment volumes, or addressing emergent financial situations. The ability to issue virtual cards rapidly empowers businesses to optimize their payment strategies in real time.

Organizations can minimize the risk of unauthorized card use by promptly canceling or replacing virtual cards as needed. This flexibility ensures that, in the event of a security concern or a change in payment parameters, businesses can take immediate action, enhancing overall security and control on virtual card fraud.

Integrating virtual card solutions with existing expense management systems represents a crucial step forward in optimizing financial processes for businesses. This integration streamlines reconciliation and enhances virtual card fraud detection capabilities.

Unlike the traditional method of manually inputting payments by accounts payable (AP) teams, the integration of virtual card solutions automates and synchronizes transaction data seamlessly with expense management systems. This automation reduces the risk of human error, expedites the reconciliation timeline, and ensures accuracy in financial records.

The real-time synchronization of virtual card transactions with the expense management system provides a dynamic and up-to-date view of financial activities, empowering businesses to identify and address any irregularities or suspicious transactions promptly. This integration not only improves operational efficiency but also protects the overall security and reliability of financial transactions.

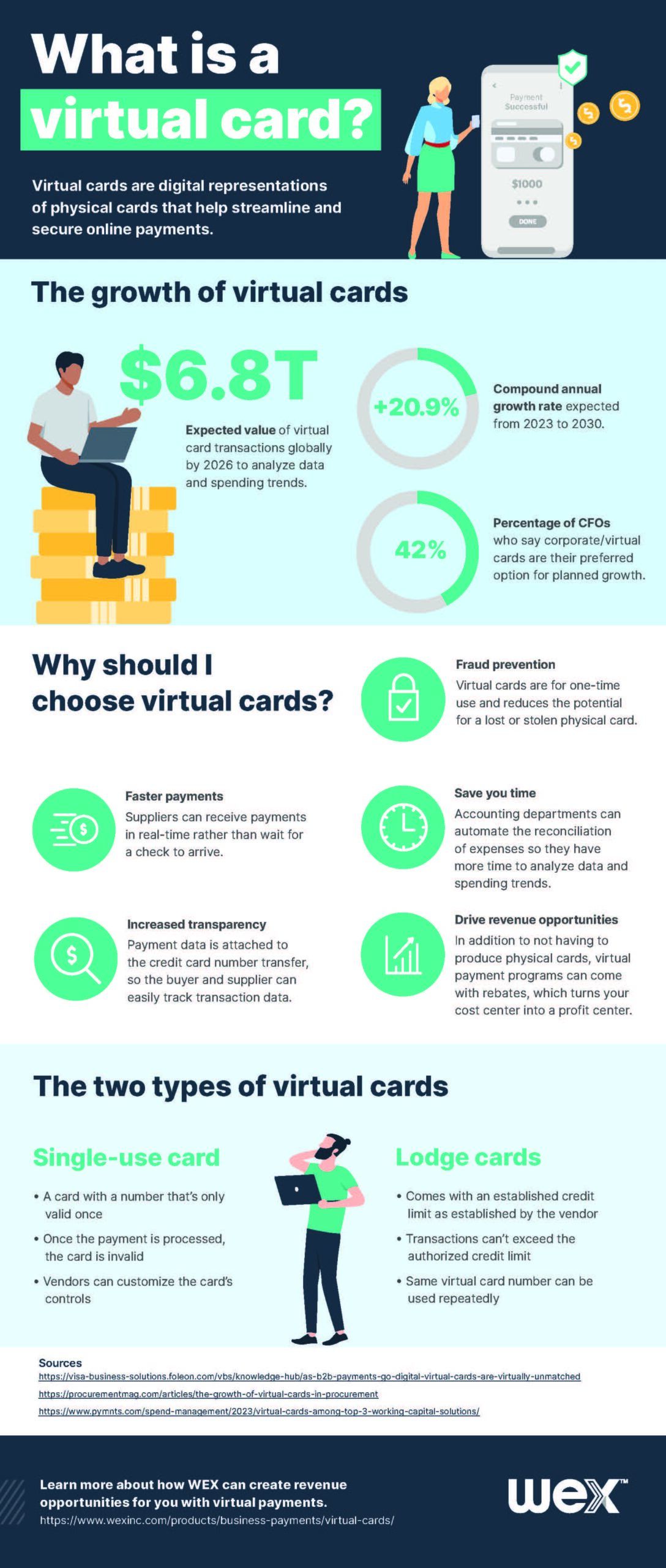

Stay up to date on the latest in virtual payments by subscribing to our blog! Simply hit “Subscribe” at the top of this blog post. And check out our infographic below to learn more about virtual cards.

For more insights and updates on corporate payments, check out:

Learn more about how WEX payment solutions can be tailored to your business, so you can accelerate and streamline operations while creating lasting growth and success for your organization.

Stay up to date on the latest in business payments by subscribing to our blog! Simply hit the “Subscribe” button above or submit your email address in the form below.

The information in this blog post is for educational purposes only. It is not legal, tax or investment advice. For legal, tax or investment advice, you should consult your own legal counsel, tax, and investment advisers.

Editorial note: This article was originally published on January 31, 2024, and has been updated for this publication.

Subscribe to our corporate payments blog to stay on top of payment innovations.