Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

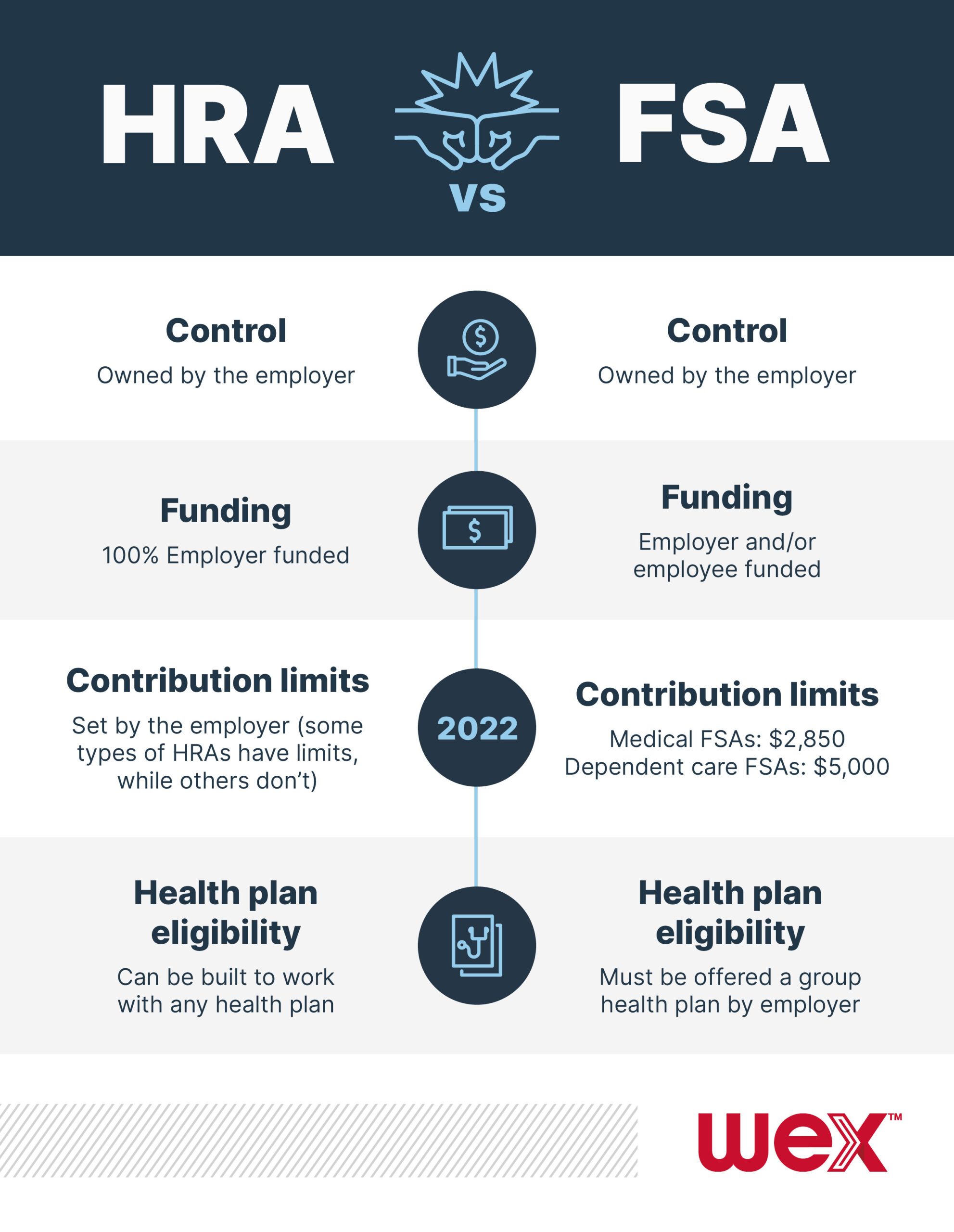

Your employees are always looking to save money. Millennial workers are interested in the perks offered with their paychecks. A health reimbursement arrangement (HRA) and/or flexible spending account (FSA) is a great perk to offer your employees. Below, we compare and contrast an HRA vs. FSA so you can see how they work and why they’re great perks to offer your employees.

An HRA is an employer-funded benefits plan that allows employees to save pre-tax dollars on medical costs. An HRA provides a unique opportunity for employers and employees because:

Discovery Benefits gives you control of your HRA design. We allow you to set your own individual goals for your participants and design your plan around them.

Flexible Spending Accounts allow both you and your employees to save money. Employees reduce taxable income, which means you won’t need to pay Social Security or Medicare tax on the funds going into the FSA. Offering Flexible Spending Accounts allows your employees to choose between our four different offered accounts:

FSAs offer pre-tax savings on eligible expenses. Employees enrolled in a medical FSA may also enroll in certain types of HRAs. Just like an HRA, a flexible spending account is employer-owned. However, employees can contribute to their FSA, while they cannot contribute to their health reimbursement arrangement.

Want to learn more about the products we offer? Subscribe to our blog, or explore more here.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.