Stay connected

Subscribe to our corporate payments blog to stay on top of payment innovations.

An October 2022 trends report from the US Travel Association shares that travel spending continues to rise and in September was up 6% above 2019 levels. This kind of reporting contributes to a buoyancy and optimism that we have not experienced in the last few years of depressed travel economics, making it an exciting time to be in travel payments. As travelers return to the roads, rails, and up into the air, we are investigating how fintechs can best react and support the changing needs of today’s traveler, airline, hospitality provider, and online travel agency (OTA). Below you will see our initial findings about business travel, leisurely expeditions, post-remote get-togethers, the merchant model, and much more.

Our OTA partners and travel agents overall have seen steady growth in the travel sector since lockdowns were lifted globally. The service providers to those agencies have also increasingly been experiencing growth. Niraj Chokshi reported on October 21, 2022 in the New York Times that United Airlines realized a $942 million profit in 2022, and likewise $695 million for Delta and $483 million for American. All three of these airlines are expecting revenue and profits in the last three months of the year to be higher year-over-year (YoY) than they were in 2019. Booking Holdings and Expedia Group have also reported continued optimism with Booking predicting 15% growth this year YoY as compared to 2019 numbers. We predict this is going to be a continuing trend for 2023 despite potential economic softening.

Along with the outright catastrophic disruption and business continuity risk that COVID brought on the travel industry, the biggest logistical disruption during COVID that negatively impacted travelers most acutely was the unprecedented level of booking cancellations due to world-wide travel restrictions. All payments that typically would be going from an agency to a supplier were being transacted in the opposite direction with much consumer angst, business viability risk, friction, and scalability challenge.

With booking cancellations, online booking customers who had their travel abruptly canceled were knocking at the door of OTAs asking for reimbursement to no avail when airlines, hotels or other suppliers were not able or, in some cases, were unwilling to provide immediate refunds. Where there were logistical, contractual and operational challenges to collecting refunds from thousands of suppliers for cancellations, the traveler became hyper-aware of the lack of flexibility or responsiveness to their need for financial reimbursement. That shock and concern has impacted the way that consumers approach their travel planning today, with the growing adoption of travel insurance and increased scrutiny of cancellation rules and services in the case of unexpected events.

Throughout the experience, travel companies have had to find ways to not only assure travelers that they will have protection from major disruption losses, but also protect themselves from the risk of financial catastrophe at the same time, which is a delicate balance.

Aside from offering travel insurance, which is now a very standard part of the booking process on virtually every site, many OTAs and partnering fintechs have found a level of cash flow protection in developing enhanced points and vouchers solutions. These solutions serve to tide travel corporations over and, for those using these solutions during COVID, reduced the cash flow crisis as customers could use the vouchers at a later date when travel resumed. The cash that could have flowed backwards was instead put into reserve for a post-COVID trip.

Now, non-cash financial credits such as travel vouchers and flexible points are likely to become an integral part of customer expectations in travel payments, not just for risk mitigation but for loyalty benefits in line with retail and card loyalty points that consumers have been enjoying for years. In 2023, we anticipate travel companies will develop processes to help customers better manage their sometimes complicated matrix of points and vouchers, developing incentives to drive consumers to have a new or enhanced perk to prioritize travel agency loyalty points that may have more flexibility for travel utilization than other programs.

Payments fintech innovation occurred as a result of an unprecedented customer issue, and we foresee more benefits of that innovation in 2023 as we face much economic uncertainty.

Globally, business travel is in a state of instability, shifting between growth and stasis and then back to growth again. As Megha Paul reports in Travel Daily Media, however, 94% of travel agents have seen an increase in new business travel customers in 2022 and 63% are optimistic looking ahead to 2023. We anticipate that, though the rebound of business travel will certainly continue in 2023, it will look different than before.

Today there are many alternatives that did not exist pre-COVID, and the level of sophistication in how we communicate, collaborate, and conduct business remotely has reduced the necessity of business travel. Corporates have proven that they can effectively conduct business remotely. Gone are the days of “road warriors,” as remote work has made much of the day-to-day business travel irrelevant and unnecessarily costly. For salespeople, there is no longer a requirement to go out and pound the pavement to connect with new prospects, and it’s no longer part of the gig as a corporate employee to travel with the same consistency as in pre-COVID times.

Business leaders have become more thoughtful when examining employee travel and more conservative in their opinion of what is considered meaningful travel that is a worthwhile business investment. With more scrutiny and choice come higher expectations about what travel should look and feel like. This puts pressure on the travel industry to adapt and provide experiences that will drive corporations to choose to have employees travel for business, and ensure a key audience is at the forefront of the communications… the business traveler themselves.

This new pressure on the travel industry to create unique and meaningful experiences includes embracing the trend of “bleisure” travel: more than before the pandemic, industry organizations (hotels, OTAs, airlines) are supporting the trend of business travelers incorporating more personally satisfying experiences into their business travel. Though business travelers have historically added time to their travels for personal adventure and relaxation time, the travel industry is increasingly cultivating and encouraging the notion, putting the idea of it in front of business travelers as they book their trip, and adding incentives, coupons, and encouragement by way of cost savings and engaging experiences. According to a recent Forbes article by Roger Sands, bleisure travel has seen a 25% increase in 2022, and business travelers have also been extending their additional luxury time even longer than in years past.

A major contributing factor to these trip extensions is, of course, remote workers’ increased flexibility. Many people no longer have to rush back to the office and now can work from anywhere. Scott Kirby, CEO of United Airlines, recently told reporters, “There’s been a permanent structural change in leisure demand because of the flexibility that hybrid work allows. This is not pent-up demand. It’s the new normal.” Travelers now spread their trips more evenly throughout the year and into historically slower travel months. Labor Day, for instance, was formerly a travel demarcation line and a cooling off period but with this shift in flexibility to work from anywhere that line has blurred.

With the rise of the work-from-home model, a previously infrequent form of business travel has become more popular than ever before: team gatherings. In the last few years, many companies have adjusted hiring to encompass a broader array of locations resulting in a geographically diverse workforce. An Ohio-based company can hire employees in Florida and New Jersey and it doesn’t matter because everyone’s online anyway. Many still feel that periodically meeting in person has value, which has given rise to work trips that bring the workforce together. For global companies, this becomes even more important with different time zones not always being ideal for relying on web conferencing to communicate and meet.

In light of these trends, there is an enhanced need for airlines and corporate travel booking tools to develop programs to streamline the booking experience for travelers whose flight destination is often corporate headquarters, such as offering a traveler-defined or pre-packaged trip: same hotel, same flights, same rental car, all in a one-stop shopping experience. The future of that experience, maybe even as early as 2023, may make it more common for corporations to also look to leverage travel service providers more routinely for other team travel logistics such as multi-team member travel coordination, event and meeting space registration, team activity enrollment and team dinner planning and RSVP.

Over the last several years, leisure travelers have shifted away from chain hotel visits towards an increase in home rentals, camping, and more localized day travel experiences. Travelers are often looking for something unique and culturally relevant to fill their need for fulfillment and connection. We’re anticipating that travel organizations will focus on those travelers and look for ways to fit into that picture.

Already, OTAs have entered the home rental market and sites like Airbnb have seen success in “local experience” booking. Similarly, large hotel chains have begun investing in unique, bespoke experiences for their guests in response to this rising demand for specialty travel. New ways of reaching travelers in a more personal way, through social media and experience-focused marketing, is growing rapidly as well. Travel organizations will need to ensure that the actual experience matches these new engagement tactics.

These elements of boutique travel and localized experiences pose new challenges of how to ensure booking, tracking, and payments are streamlined to meet the needs of the travelers. As these trends are likely to continue throughout 2023, more fintech solutions will continue to be at the forefront of solutions strategies with the goal to avoid any traveler disruption or frustration.

Using technology to provide a personal experience is going beyond streamlining and avoiding disruption. Earlier this year, Dana Dunne, CEO of European OTA eDreams ODIGEO reported for Forbes on the future of personalization in travel booking. Dunne shared that 63% of customers will stop buying from brands that use poor personalization tactics. McKinsey predicts that travel companies will adopt personalization tactics in the coming year to bring what is now used less than 10% industry-wide to 30% by 2030.

Travel corporations, mining data on behavior, will be able to provide a personalized experience to each consumer. The vision is that if a consumer goes on an OTA app and the person sitting next to them is on the same app they should be looking at completely different things because they have been served a personalized experience by the technology. This, we believe, is going to drive the next level of innovation in travel technology going into 2023.

Booking travel via mobile technology increased 63% since the start of the pandemic. With that increase came a shift in consumer expectations about the mobile experience. Consumers are accustomed to the ease and increased productivity apps provide, and as a result, their experiential expectations have changed. We anticipate mobile app payments will gain more ground in 2023 with increasingly streamlined processes.

Hopper, the rapidly growing travel booking, price optimization, and payments application, is an example of a company that has long embraced these altered expectations – their baseline product offering was an app. They launched the app as the primary mechanism for booking travel right from the start, and it has proven to be a great approach to the market.

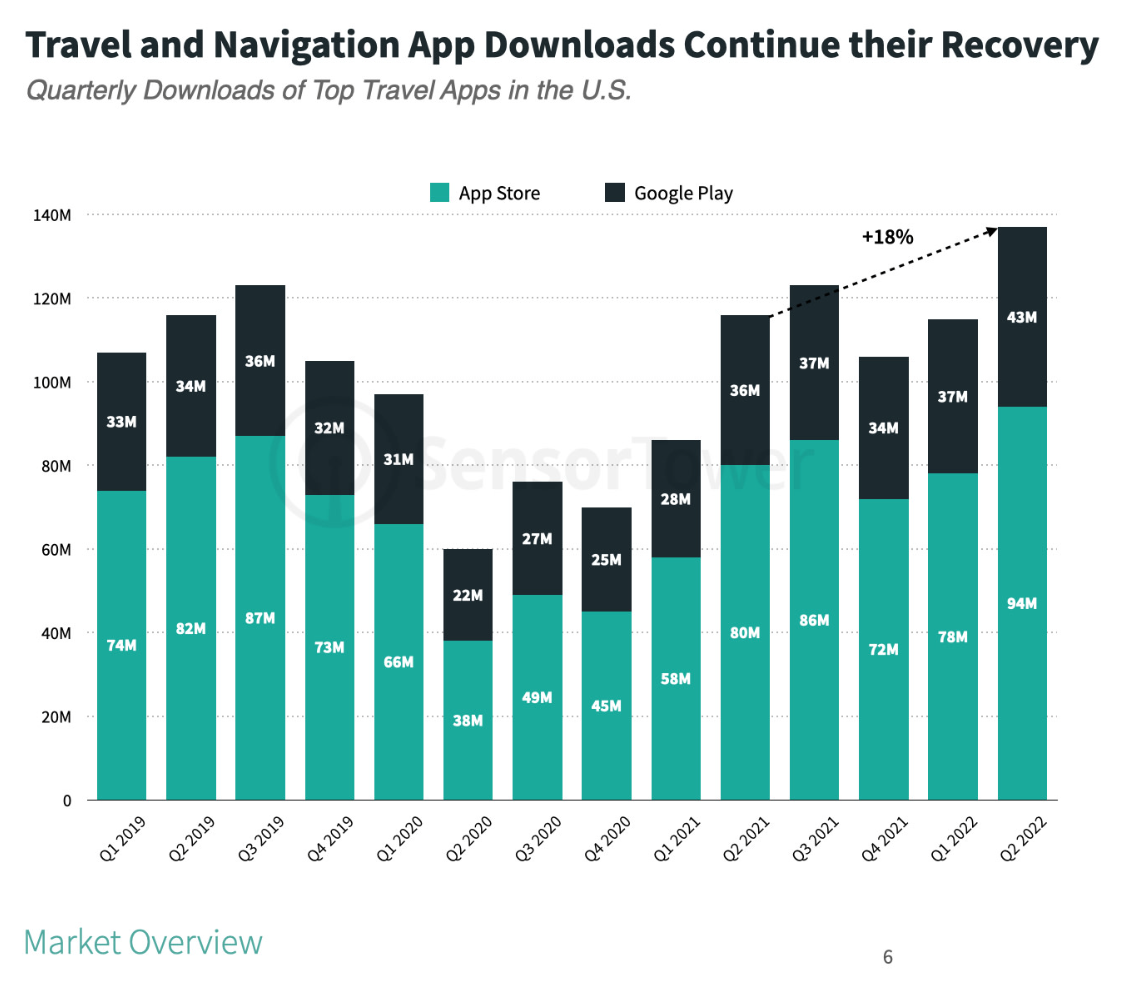

From a July 2022 article in “Sensor Tower:” Illustrates increased use of travel apps.

As innovations continue to flood the mobile travel experience, we envision that it will soon be a standard expectation for consumers to be able to use a single app to pull up their airline tickets and hotel reservation, check in and out, access payment information, add amenities and activities, and make changes on the fly using the same payment method as was originally used or choose from their wallet of personalized payment options.

Along with increased consumer use of mobile apps came a “quick switch” mentality: shifting between providers when faced with road blocks is easy on a mobile device. If an app isn’t working, consumers simply delete it from their phones and find a superior app. In a recent article on Jotform, Aytekin Tank reported that only 8% of consumers surveyed stated they were loyal to the brands they shopped. This means 92% of consumers regularly switch between providers, and the power is in their hands. The increase in the use of mobile apps and spontaneous bookings rose sharply in 2022 – with travel apps seeing 137 million downloads from the U.S. App Store and Google Play in Q2 2022 – up 18% year-over-year from 116 million in Q2 2021.

It’s not enough to provide online booking: consumers want even more control and immediacy. To be competitive, companies have to provide a seamless experience every time a consumer is on mobile or they will lose that customer. As a result of this trend toward the app, there will be a continual need to further streamline processes for consumers throughout their entire travel experience, and create apps that notably improve that experience in unique ways.

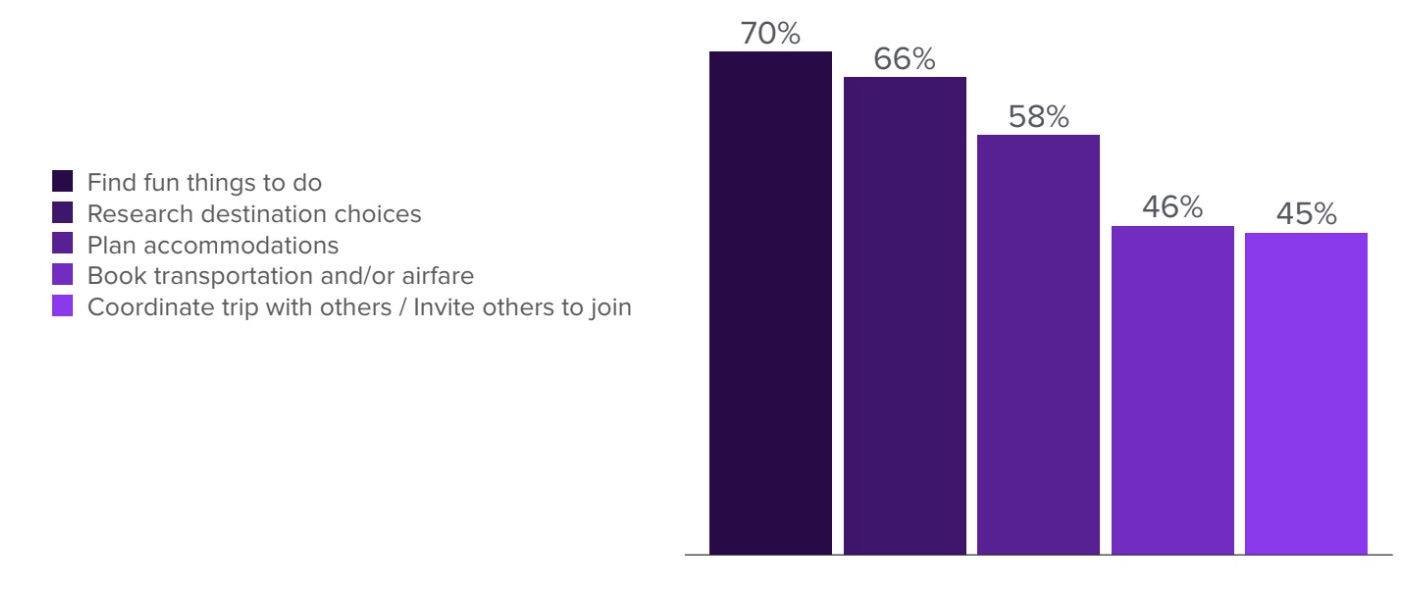

Graph provided by Business of Apps: How people are using their phone when booking travel.

Interest rates and fluctuations in inflation are wreaking havoc on cross-border payments. This is a point of volatility for travel companies that have to adjust to exchange rates and cross-border fees, and seems likely to continue as we head into 2023. Today’s technology can’t keep up with all the changes in cost and interest rates country by country. Due to current global volatility in the economy, a lot of that cross-border work has to revert to manual processes. Getting the numbers right at the initial point of transaction is crucial as adjusting later brings with it additional costs that build up over time.

For global travel service providers, working with a payment services provider that can offer a multitude of originating regions, currencies, and product options will help reduce the unpredictability of global transactions. WEX offers multiple issuing regions, over 19 currencies, and dozens of payment product options to process, settle, and collect, which significantly diminishes the cost and improves the flow of global transactions. We see these cross-border payments disruptions to be a continuing trend to contend with in 2023.

Some of us might remember, in the past, travelers had to go to several different websites to book a trip, manage a change, or reach customer service, which is less and less the norm. With the rapid rise of intermediaries over recent years, booking has become more consolidated, however the points of connection for payments, changes or service issues have remained dispersed in many cases.

The disruption to travel in the pandemic, especially considering mass cancellation and refund processes, put a spotlight on the inefficiency and pain of such a disconnected back-end process. As the entry point of travel engagement, the booking agency is becoming more concerned with the end-to-end consumer experience: it is increasingly becoming a requirement that all service and issue resolution can be offered in one place, seamlessly.

Also, the rise of new, innovative payment mechanisms that consumers have begun to expect has driven travel booking and service providers to partner with numerous payments fintechs who provide a richness of optionality for how a consumer wants to pay for their travel. This is a major technical investment in consumer-friendly optionality that has made travel booking and consumer payment equally important to online strategies around user experience.

The seamless travel booking experience – especially considering critical payment and refund flows – that consumers are now expecting has, in many cases, been enabled by the growing popularity of the merchant model among travel intermediaries. The merchant model allows the booking entity, such as an OTA, to settle the customer transaction as the merchant via a myriad of mechanisms. The OTA can then pay the suppliers, such as hotels and airlines, from their bank, based on their own contractual terms with each supplier. This in turn allows the booking entity to take all the different facets of travel booking and consolidate them for the traveler all the way through payment and issue resolution.

Though this model has gone through its growing pains, improvements in how booking entities and partnering suppliers, such as hotels, manage payments continue to be made as they work more closely together to ensure the customer’s experience is at the heart of the process. The days are passing where there is a frustrating disconnect between the agencies or OTAs and the suppliers, as the communication and integration capabilities are maturing. Then, when there are issues with a consolidated online booking, OTAs that are committing to full end-to-end customer service have the control to help the consumer deal with travel disruptions with one phone call or chat instead of being forced to juggle between the multiple service providers for resolution.

We predict a growing trend in 2023 will be OTAs offering their technology and inventory solutions to smaller travel agencies and other entities supporting travel booking as part of an awards or member-driven experience. Many OTAs, such as Expedia and Priceline, are already powering thousands of travel-booking sites. Earlier this month, Expedia launched a new product, “Open World Accelerator,” that is designed, according to its launch document to “advance innovation in the travel industry, by supporting startups and small and medium sized business (SMBs) to fast-track their growth and innovate on Expedia’s purpose-built technology platform.” Others, such as Hopper, are offering unique fintech and pricing control tools to the marketplace. One example is Hopper’s recent partnership with CTrip, with a goal to put more control into the traveler’s hands when they are planning or potentially dealing with changes in their travel plans.

Airline, bank, or card rewards travel offerings have been frequent users of these solutions as well. Hopper’s partnership with Capital One provides the solution for a cardholder that has rewards points with Capital One and wants to use them to book travel. Hopper handles the backend of Capital One rewards-enabled travel booking.

These entities are recognizing year over year that the more technical and processing assets they have available for integration and embedding – from booking and pricing leverage, to data analytics and payment capabilities – the more they will bring powerful enablement tools to even more entities that may not be inherently travel-focused but need sophisticated tools for their ancillary product lines. Payment technologies and products that enable flexible, tightly integrated, and reliable delivery mechanisms powering these assets are critical to the growth and value of these products to all stakeholders including the traveler, service provider, booking engine, and supplier alike.

As we look to 2023 what’s most exciting to us is the travel industry’s renewed focus on the customer experience. As COVID measures and fears fall away, and people venture out of their homes once more, the travel industry has a unique opportunity to provide joy. Travel and hospitality organizations, tour operators and the entire ecosystem of travel offerings to the business and leisure travelers of the world provide the possibility of encountering new experiences, and coming into contact with cultures beyond our usual spheres. Now is the time to improve people’s experiences as they travel, to make their trips more flexible and seamless, and to encourage spontaneity.

In 2023, we anticipate more collaboration across the industry as a whole – it’s becoming a cohesive ecosystem and every facet of travel is equally important. We’ve been able to be more engaged with customers and partners about how we can help them with their broader vision for what they want to be as a company, what they want to provide to their consumers, and what they want to provide to the industry in general, and that’s exciting. We can do so much more together.

Learn more about how WEX travel payment solutions can be tailored to your business, so you can accelerate and streamline operations while creating lasting growth and success for your organization.

Resources:

New York Times

McKinsey & Company

Expedia

Deloitte Insights

Business of Apps

PhocusWire

The Economist

Travel Daily Media

Business Report

Sensor Tower

US Travel Association

Forward-Looking Statements made by WEX

This article contains links to our website, which may contain forward-looking statements pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical facts may be deemed to be forward-looking statements. When used on our website, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will”, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. These forward-looking statements are subject to a number of risks and uncertainties.The forward-looking statements speak only as of the date of publication on our website and undue reliance should not be placed on these statements. WEX disclaims any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

Subscribe to our corporate payments blog to stay on top of payment innovations.