Stay connected

Subscribe to our corporate payments blog to stay on top of payment innovations.

Over 90% of payment leaders encountered difficulties when paying suppliers in the past year, according to the PYMNTS 2024 Certainty Project Report.

Businesses today are dealing with unprecedented levels of financial uncertainty. Fluctuating market conditions, geopolitical tensions, and supply chain disruptions have created a perfect storm, making it a challenge to manage cash flow and maintain financial stability.

As a result, heads of payments are looking for the best ways to drive efficiency and reduce uncertainty in their corporate payments.

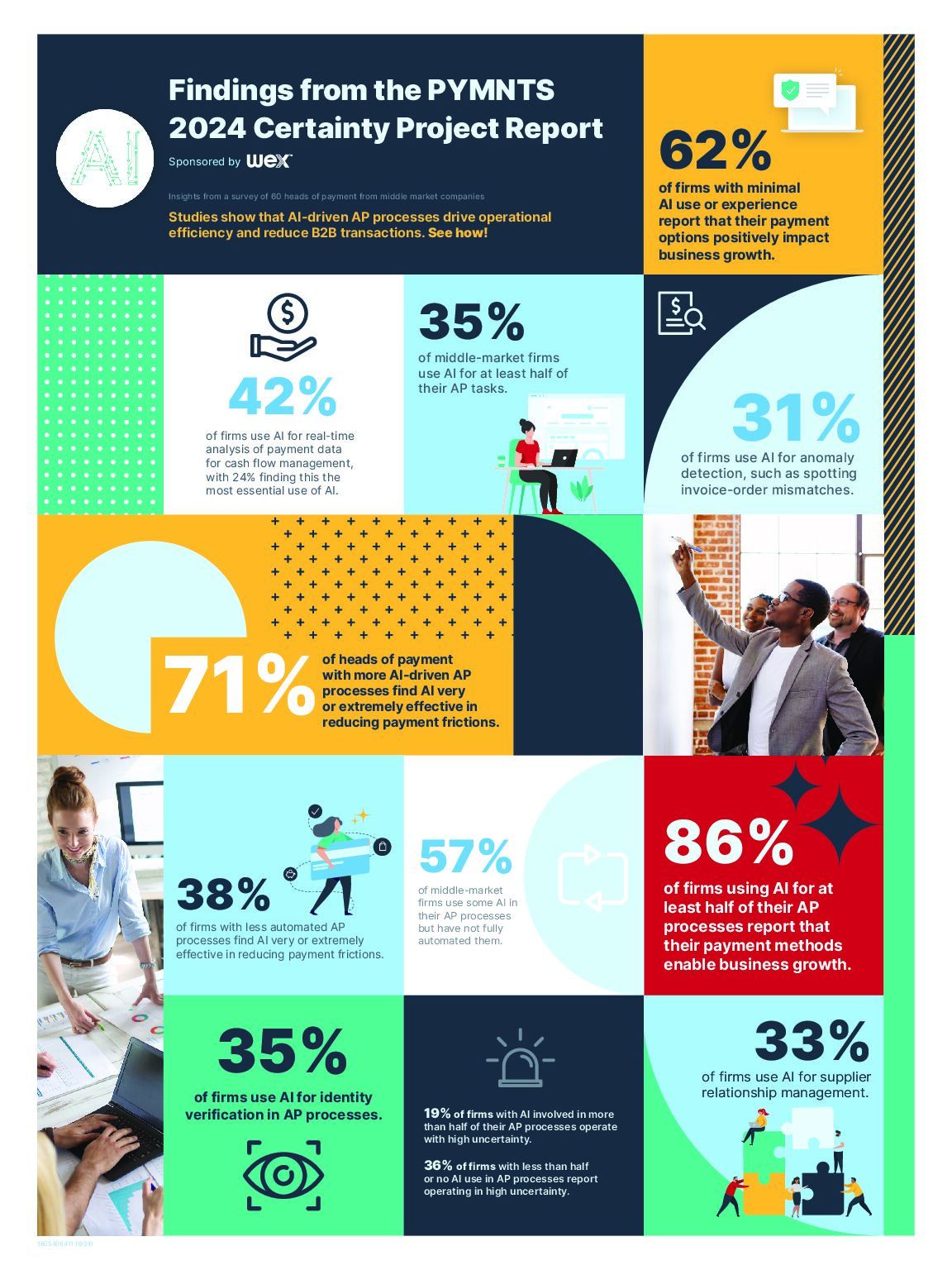

As part of our ongoing ‘Beyond corporate payments’ series, we’re revisiting insights from the PYMNTS 2024 Certainty Project Report, sponsored by WEX. The report highlighted how secure payments and AI integration help mitigate risks in today’s turbulent industry while supporting continued business growth.

Part 2: Build better supplier relationships through secure payments

Part 3: The power of flexible, fast payments to drive business growth

The study revealed the multitude of challenges businesses face related to payments. These include late payments from customers, supplier payment delays, and difficulties in reconciling accounts. These problems can hurt a company’s cash flow, causing financial instability and hindering growth. But there are innovative solutions making waves: Artificial intelligence and automation.

For businesses of all sizes, maintaining a healthy cash flow is a top priority. A steady stream of incoming funds is essential for covering expenses, meeting payroll, and investing in growth initiatives. Yet, managing cash flow can be a complex balancing act. This is why heads of payments are looking past traditional methods, searching for tools that improve efficiency and security.

Download our AP Buyer’s Guide to compare options and find the best fit for your accounts receivable and payable workflow

Traditional cash flow management often relies on manual processes and outdated tools. Time-consuming tasks like data entry, reconciliation, and forecasting are prone to human error. Additionally, relying on historical data to predict future cash flow needs can be insufficient, especially in unpredictable markets. These limitations can translate into missed opportunities, inefficient use of resources, and ultimately, a strain on financial health.

Digital and automated payment solutions are maturing, allowing businesses to transition past paper-based methods and adopt tools that are faster, while experiencing fewer obstacles and greater growth.

Click here to learn why you should make the switch

To address financial uncertainty, businesses are increasingly turning to AI-powered solutions in their accounts payable departments. By automating manual processes, improving data accuracy, and providing real-time insights, AI can help businesses to:

Companies using AI in their payment processes are much more likely to find it helpful in reducing payment problems. In fact, according to the report, 71% of companies with more AI-driven AP processes rate AI as very or extremely effective in reducing payment frictions, compared to just 38% of companies with less automated AP processes.

According to the report, most companies use AI in their payment processes to analyze payment data and manage cash flow as transactions occur. 42% of companies do this, and 24% say it’s the most important use of AI. This helps keep financial records accurate and predicts cash flow problems quickly, leading to better decisions.

AI algorithms can help identify suspicious patterns in payment data, helping to prevent fraud and protect sensitive financial information. 31% of firms use AI for anomaly detection, such as spotting invoice-order mismatches.

AI can improve security and transparency by verifying identities and reporting. 35% of companies use AI to verify identities, which helps manage vendors and approvals and reduces risk. Check out more findings from the study below:

One of the most significant findings is the correlation between AI use and business growth. The study shows that companies using AI in their AP processes experience higher operational certainty and growth. Companies using AI for most of their payments are 86% more likely to have payment options that help them grow compared to companies using little AI.

Subscribe to get the latest on business payments.

As AI continues to develop, businesses are recognizing more tangible benefits:

Improved supply chain efficiency: Businesses can leverage AI to optimize inventory levels and payment schedules with suppliers. This reduces the risk of shortages and overstocking, both of which can impact cash flow.

Enhanced customer relationships: AI can improve customer experiences by offering flexible payment options and automated reminders. This leads to faster payments and fewer outstanding invoices, boosting cash flow.

Data-driven decision making: AI-powered insights allow businesses to make informed decisions regarding discounts, payment terms, and resource allocation. By making informed decisions based on data, businesses can reduce financial strain and improve operational efficiency.

While AI offers a powerful solution for cash flow management, it’s not a one-size-fits-all approach. Businesses should carefully evaluate their specific needs and resources before implementing AI solutions. Integration with existing systems and employee training are important aspects of a successful AI adoption strategy.

However, the potential benefits of AI are undeniable. By leveraging AI’s analytical power, automation capabilities, and predictive insights, businesses can gain an edge in managing cash flow. This translates into improved financial stability, reduced risk, and greater opportunities for growth in the long run.

Explore how WEX solutions can help you gain efficiencies, cut costs, and generate revenue.

Contact us to get started

For more insights and updates on corporate payments, check out:

Learn more about how WEX payment solutions can be tailored to your business, so you can accelerate and streamline operations while creating lasting growth and success for your organization.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax, and investment advisers.

Subscribe to our corporate payments blog to stay on top of payment innovations.