Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Flexible spending accounts (FSAs) allow your employees to use pre-tax dollars to cover eligible out-of-pocket healthcare expenses, providing a tax-efficient way to manage medical costs. But there are some FSA rules you need to follow to stay compliant. Keep reading to learn more about FSA compliance and how to design an FSA plan at your company.

Check out our other compliance blog posts on HSAs, HRAs, LSAs, and voluntary benefits.

Employee eligibility for FSAs typically requires enrollment during your company’s open enrollment period, or at the time of hire or a qualifying event. Employees must be eligible for your company’s health insurance plan to participate in an FSA. The four common types of FSAs are:

Medical FSA: Allows employees to use pre-tax dollars to cover eligible medical expenses not covered by insurance, such as copays, deductibles, and certain over-the-counter medications.

Limited medical FSA: Similar to a medical FSA, but can be paired with high-deductible health plans (HDHPs) and health savings accounts (HSAs), covering dental and vision expenses.

Combination FSA: A limited FSA that converts into a medical FSA once the IRS deductible is met.

Dependent care FSA: Lets employees use pre-tax funds for qualified dependent care expenses, including daycare, preschool, and after-school care. Only employees with a legitimate tax-dependent status can use FSAs to cover dependent care expenses.

The IRS sets an annual limit on the amount that can be contributed to an employee’s FSA. The 2025 medical FSA contribution limit (including limited and combination FSAs) is $3,300 per year. While you have the option to contribute to your employees’ FSAs, it is not mandatory. The funds your employees choose to contribute will be deducted from their paychecks before tax deductions and then placed into their FSA.

The FSA use-or-lose rule means that any funds remaining in an employee’s FSA at the end of the plan year are forfeited. In other words, they lose those funds if they don’t spend the money they contributed to their FSA on eligible expenses by the end of the plan year. However, there are two exceptions to this rule:

FSA eligible expenses vary depending on the type of FSA. Here are some common categories of eligible expenses for different types of FSAs:

Medical FSA:

Limited medical FSA:

Dependent care FSA:

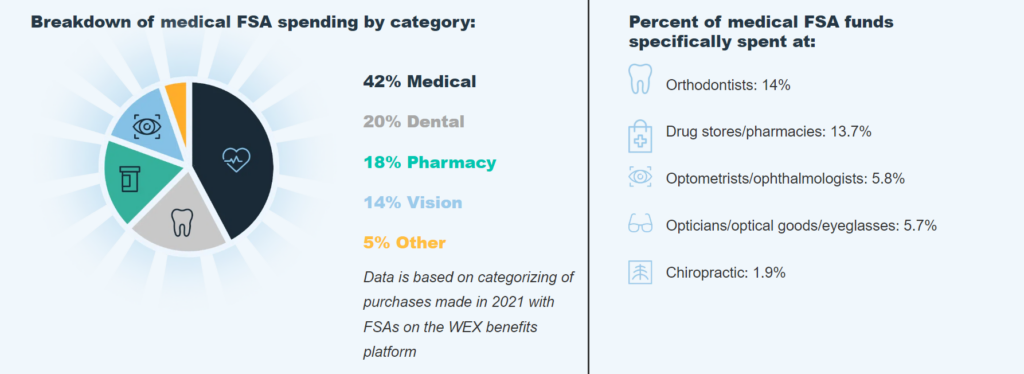

Discover more about how participants use their FSA funds:

When your employees spend their FSA funds, they should follow this general guideline:

Use a benefits card: Some FSAs offer a benefits card that can be used for eligible purchases directly at the point of sale. Swipe the card at the point of purchase, and the funds will be deducted from the FSA account.

Save receipts for FSA-eligible purchases: Documentation is crucial for substantiating expenses, especially in case of an audit or verification. Even some benefits card purchases will require receipts for substantiation.

Submit claims: For purchases made out-of-pocket, participants will most likely need to submit a claim for reimbursement. Depending on the FSA provider, this might involve filling out a claim form and providing documentation.

Here are some important considerations when designing an FSA at your company:

Learn more about FSAs and other employee benefits by subscribing to our blog!

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.