Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

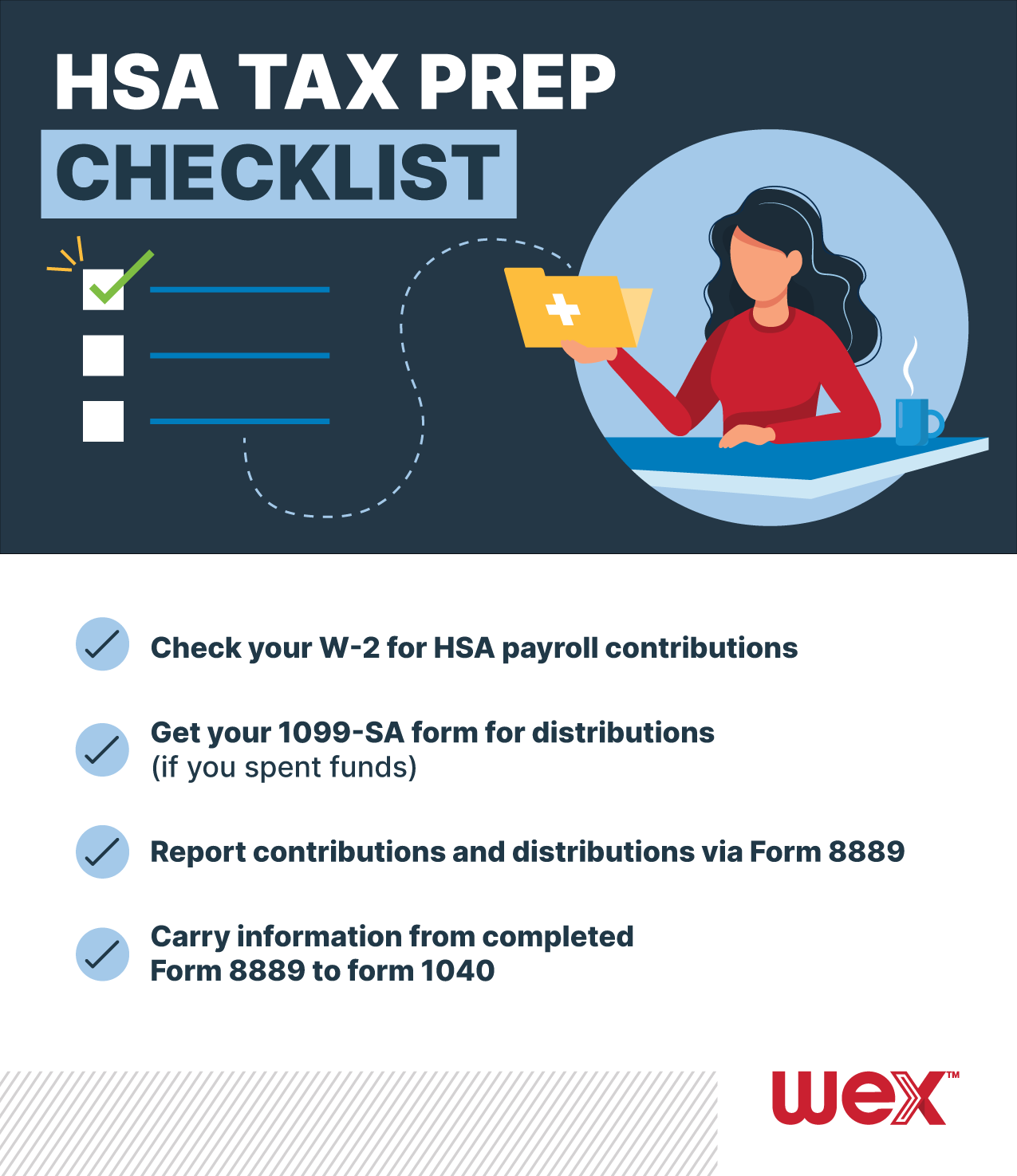

The season for filing taxes is upon us once again. We’re getting closer to the deadline for filing for 2024. We wanted to share a few tips and reminders about the health savings account (HSA) information you’ll need for your tax return. These will help you get organized and prepared for easy and successful filing.

Provided by your employer, your W-2 shows the wages you earned and any taxes withheld. It also shows pre-tax contributions made to your account by you and your employer through payroll deductions. (Remember, only contributions made through payroll will show up on your W-2 – if you made any contributions outside of your payroll deductions, sometimes referred to as ad hoc contributions, they won’t be reflected and will need to be included when filing your taxes.)

A 1099-SA is the HSA tax form that reports distributions from your account. You’ll need this form when filing your taxes.

On the other hand, a 5498-SA reports contributions. It’s a little different from your W-2 because it’ll show any contributions – not just those made through payroll deductions. HSA administrators have until June 2, 2025 to issue Form 5498-SA to HSA participants. This form is not a requirement when filing taxes.

The recipient instructions provided with each of these forms walk you through which boxes reflect which information, as well as basic instructions on how to use the forms.

WEX’s HSA participants can find the tax forms related to their HSA by following these steps.

Form 8889 is used to report any distributions from and contributions to your health savings account. Think of this form as the place where the numbers from forms 1099-SA and 5498-SA or W-2 come together. Any distribution amounts reflected on your Form 1099-SA need to be reported on this form, where you’ll also indicate which distributions were eligible for medical expenses. And any contributions made to your HSA should also be listed on this form – you’ll then carry that information over as deduction information on your Form 1040 (or the main tax form you fill out and file for your tax return). This article walks you through how to complete Form 8889.

Looking to make additional contributions to your HSA? The good news is that if you haven’t filed for the tax year yet and haven’t maxed out your annual contribution, you can still make additional contributions to your HSA to count toward the prior year. Normally, it’s recommended to do it by early April to be sure there’s enough time for any changes to process in your account and allow you to still complete and meet the tax return deadline.

If you’re a WEX participant and make a contribution between January 1, 2025 and April 15, 2025 that you want to be allocated to the 2024 tax year, just be sure to notify us through your online account or with the HSA Contribution Form that the contribution was for 2024.

Please note: In a couple states, HSA funds are taxed.

Subscribe to our blog for the latest insights on employee benefits. Simply hit the “Subscribe” button above or submit your email address in the form below.

This blog post was most recently updated in March 2025.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.