Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Providing cutting-edge employee benefits that meet your employees’ needs is vital in supporting recruiting and retention. And we are in the heart of open enrollment planning season for many employers.

WEX is in a unique position to educate you on the latest benefits trends because of our wide data pool built on our WEX benefits platform. Join us on our three-part series as we explore the top actionable benefits trends from that data to help you support your employees. I’m kicking off our benefits trends series by discussing the latest trends around one of our buzziest benefits: lifestyle spending accounts (LSAs).

Get the latest

benefits trends!

Go to our webpage.

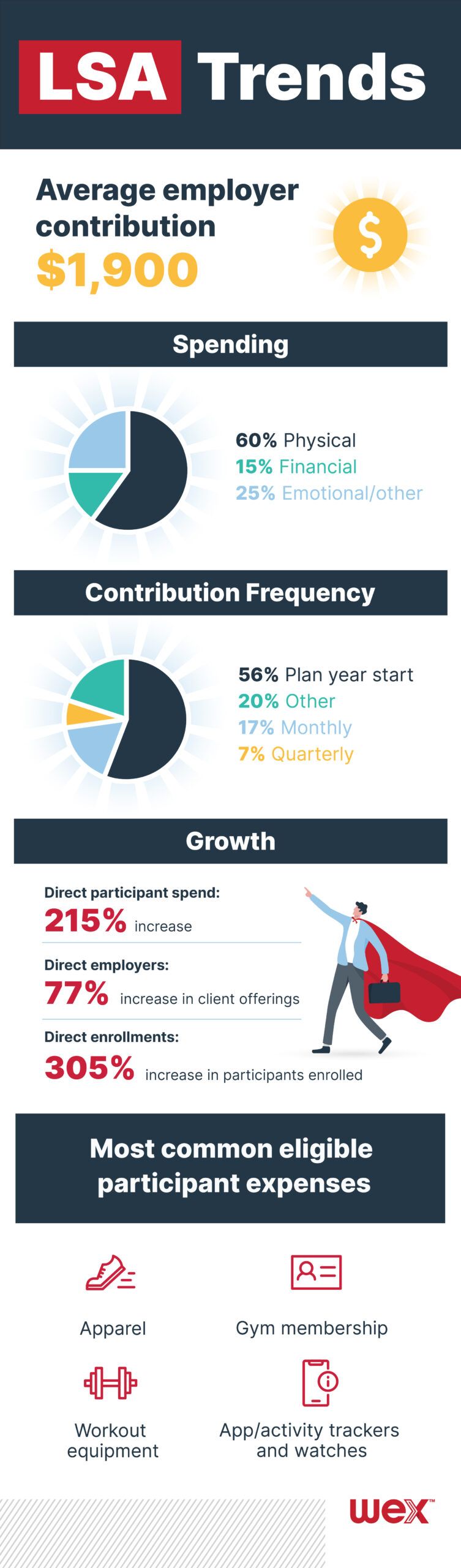

Many more employers are offering lifestyle spending accounts in 2022, especially as a recruitment and retention tool. LSAs are post-tax accounts, allowing employers the opportunity to customize an LSA and decide how often funds are distributed into the account and what types of purchases are considered eligible.

Our data shows there has been a 77% increase in our direct employer clients offering LSAs from 2021 to 2022, with the average employer contribution at $750 for companies with less than 5,000 employees. Over half of LSAs (56%) have funds contributed at the start of the plan year, while 17% have funds contributed on a monthly basis.

Lifestyle spending accounts have become much more popular among employees as well. In fact, there’s been a 305% increase in participant direct enrollments from 2021 to 2022. Employees are drawn to LSAs because they are funded by their employer and they can be reimbursed for purchases of eligible physical, emotional, and financial wellness expenses.

Overall, there has been a 215% increase in LSA direct participant spend from 2021 to 2022. Majority of the spend goes towards physical expenses (60%), while 15% is spent on financial expenses, and 25% is for emotional/other expenses. The most popular eligible participant expenses are apparel, gym memberships, workout equipment, and apps/activity trackers and watches.

Interested in learning about HSA and FSA trends? Check out more 2022 benefits trends here!

Or watch our podcast episode below for a full look at trends we’ve uncovered across multiple benefits.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.