Optimize your business payments

- Gain efficiencies

- Cut costs

- Generate revenue

Optimize the procure-to-pay process

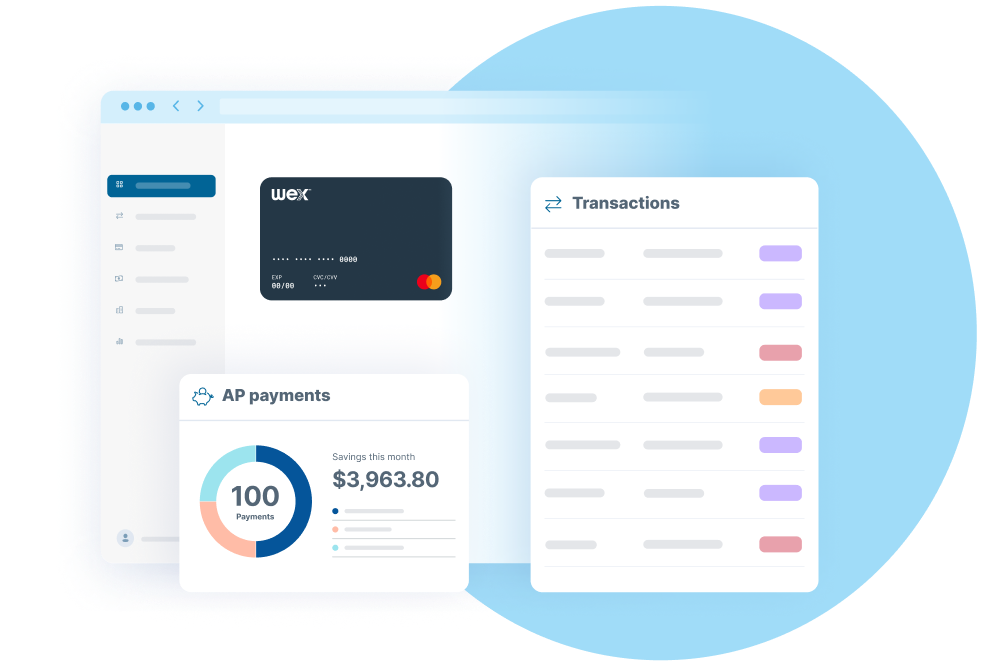

See how WEX simplifies business payments

From virtual cards to payment delivery, WEX helps you take control of the end-to-end payments process all in one place. Gain better visibility, strengthen security, and even generate revenue through rebates along the way.

Use our platform or integrate with yours

WEX works with you to simplify your procure-to-pay process so you—or your platform customers—can create measurable returns.

Use our platform to pay and get paid

Business payments can be more than just a way to meet obligations to suppliers. With WEX, you can:

- Reduce reconciliation time with enhanced data

- Strengthen relationships with suppliers

- Pay suppliers through multiple methods

- Generate revenue via rebates

Add payments to your platform

WEX works closely with you to meet your business goals, and those of your clients, by designing and deploying an easy, fast and scalable integration.

- Expand your payments capabilities by integrating our platform with yours

- Flexible rebate sharing options

See what our customers are saying

“Partnering with WEX has helped us offer a simple, sophisticated solution for our clients.”

Maria Line

FNBO Head of Customer Engagement, Portfolio Management & Commercial Card

Industry solutions for your specific needs

Stay connected

Sign up for our Corporate Payments Edge newsletter to stay on top of payment innovations.