Stay connected

Subscribe to our corporate payments blog to stay on top of payment innovations.

As businesses continue to adapt to changing work landscapes, the transition to digital payments has accelerated. The rise of remote work, combined with a growing preference for contactless interactions and streamlined processes, has driven companies to move away from traditional paper payments. Even back in 2019, the “virtual credit card” created a buzz in the payments marketplace. Today, the use of virtual credit cards is a commonly used form of corporate payment.

A virtual payment is a digitally tokenized card number. There are different kinds of virtual payments which include single-use cards, lodge cards, and third-party virtual cards. One of the most common kinds of virtual payments is a single-use account. This is where the holding company of the card generates a unique string of numbers, connected to a company’s bank account, which can be used for just one payment.

Companies can set controls on single-use virtual payments that limit the amount, date, merchant, and even MCC codes, among other parameters.

Here’s an example:

If you send a single-use virtual payment to your office supply store, you can specify the exact amount the merchant should process to receive payment (down to the penny). You can also limit the date range during which that virtual payment is valid.

Single-use virtual card numbers are designed for one use only. After virtual payments are made, the single-use number becomes invalid and cannot be reused. This reduces the likelihood of fraud because it is a one-and-done system. It reduces the transaction time and decreases the vulnerability of the user account to outside, unauthorized interaction.

With virtual payments, you can choose to record additional information about the payment in the notes of the transaction. This can be project codes, cost center info, or other information relevant for your business.

In addition to the added data mentioned above, virtual payments also provide the ability to include customized data capture fields. For example, if you’re paying for a hotel expense, you can include a customized data capture field for the booking ID number.

Virtual payments include a full audit trail with real-time data analytics.

Suppliers can speed up payment collection with virtual payments. This reduces the number of days it takes to receive payment after a sale. Faster payments also improve working capital, giving companies more financial flexibility.

Since virtual cards are digital, costs associated with issuing, mailing, and maintaining plastic cards are eliminated.

There are several varieties of virtual credit cards available today, with different strengths.

A virtual credit card doesn’t come in the form of a physical plastic card and instead exists only as a card number. They are issued to customers when they want to make an electronic payment without using their plastic card number or an existing credit card account. Virtual cards are typically used for transactions that take place online, and they can also be used for transactions over the phone or in other instances of card-not-present transactions. The virtual card number functions similarly to a token and can’t be traced back to another credit card or bank account. This keeps both the card information and the customer’s identity secure while allowing for controls on the transaction just as if the actual credit card were being used.

Virtual credit cards were introduced in the early 2000s and initially were limited in their use; they were primarily used by travel-related businesses and companies with fleets of vehicles. In recent years, however, a wide range of other industries have realized the value of using virtual cards for electronic B2B transactions.

Virtual cards can be single-use or what are called “lodge cards.”

Single-use means just that — it’s a virtual card number (from a single-use virtual account) that is valid for just one use. Once that single-use payment has been processed, the virtual card number becomes invalid. Single-use virtual cards have tight controls associated with them, such as the amount (which can be a range of amounts or one specific amount), expiration date, merchant, and even MCCs, among other parameters.

With amounts, single-use virtual cards can be authorized to use with one exact amount only (such as $100), or they can be authorized for multiple transactions that ultimately result in that one exact amount (such as five $20 transactions).

Single-use card payments are popular because vendors get paid faster and experience more efficient reconciliation in the process.

A lodge card has an established credit limit for invoice payments and/or for goods and services. A lodge card number can be input into a POS terminal more than once, but transactions can never exceed the authorized credit limit. As with single-use and third-party virtual cards, lodge cards typically have controls that can be set for expiration dates, MCCs, etc. Given that lodge cards make transactions with the same virtual number over and over, they’re generally used sparingly and only with highly trusted vendors.

Whether you adopt single-use, lodge, or a combination of these virtual card types, each one offers customizable security, efficiency, and control necessary for electronic B2B payments.

Virtual credit cards can improve your accounts payable system by providing transparency and efficiency to day-to-day processes. As cash management practices evolve and the global economy advances, automation is increasingly transforming bank accounts and credit cards. Automation is more efficient and more accurate than manual management.

Traditionally, the accounts payable (AP) processes have been managed manually, an approach that is both tedious and error-prone. Lack of efficiency in manual processes can lead to risks for your company magnified by the possibility of human error. Consequently, the transition from human resources to automation is a welcome one in AP.

Converting your accounts payable department to a virtual AP department would mean transitioning to electronic payments using single-use or lodge virtual cards. This move to virtual AP will lower costs, help you mitigate risk, and optimize discount administration and buyer/supplier collaboration. Improving your company’s AP technology can give you the ability to leverage payments and data to save time and eliminate inefficiencies.

The increased controls and visibility offered by a virtual AP system can help you mitigate risk internally and prevent potential fraud. With virtual payments systems and tools, your company can achieve margin improvements and discount advantages from optimized payables.

The advantages that come with implementing a virtual accounts payable program benefit the buyer and supplier in the B2B payable structure.

The most efficient and seamless way to pay suppliers for invoice-based spend is with virtual credit cards. Virtual credit cards offer access to broad acceptance via the payment network and provide highly customizable security controls. With strategic supplier enablement, buyers will be able to facilitate accelerated supplier participation and allow for maximum program results.

A virtual AP system can manage expenses with the following benefits:

Almost all companies use some form of an ERP (accounting) system to help manage AP. Most companies are looking for a seamless way to process their payables liabilities, regardless of payment type (check, ACH, card). While very few financial institutions or third-party software providers offer a seamless and automated way to support these payments, smart integrated payables solutions provide a comprehensive way to process supplier payments, regardless of payment type.

Three ways integrated payables can optimize payments:

As businesses seek to improve cash flow, supplier terms management can be a valuable strategy for improving and optimizing the cash conversion cycle. Virtual credit card AP and managed payables solutions will deliver a seamlessly integrated, fully automated solution using all payment modalities – including virtual cards, EFT with discount administration, or check – and will connect buyers with suppliers through a simple pay file integration. Managed payables reduce manual processing and facilitate comprehensive supplier/terms management to maximize margin improvement, efficiency, and control for powerful payment optimization.

Virtual credit card payments improve the efficiency and effectiveness of the AR and AP processes. A virtual card number (VCN) stands in for the details of the remitter and translates that information for the B2B customer’s account statement.

Virtual credit card payments offer significant benefits to companies including some of these most recognized advantages:

Electronic payments, transfers, and automatic deposits are not just for the convenience of the consumer. By adopting virtual card payments, businesses can take advantage of lower processing costs, gain internal control through automated account reconciliation, and mitigate risk with less paperwork.

If you haven’t yet looked into virtual payments for your business, now may be the perfect time to explore. Talk with one of our consultative experts to learn about how to pay your vendors with single-use virtual card payments.

By transitioning to virtual payments in your Accounts Payable department, you can see benefits such as reduced fraud risk, improved payment and remittance data, and lower costs.

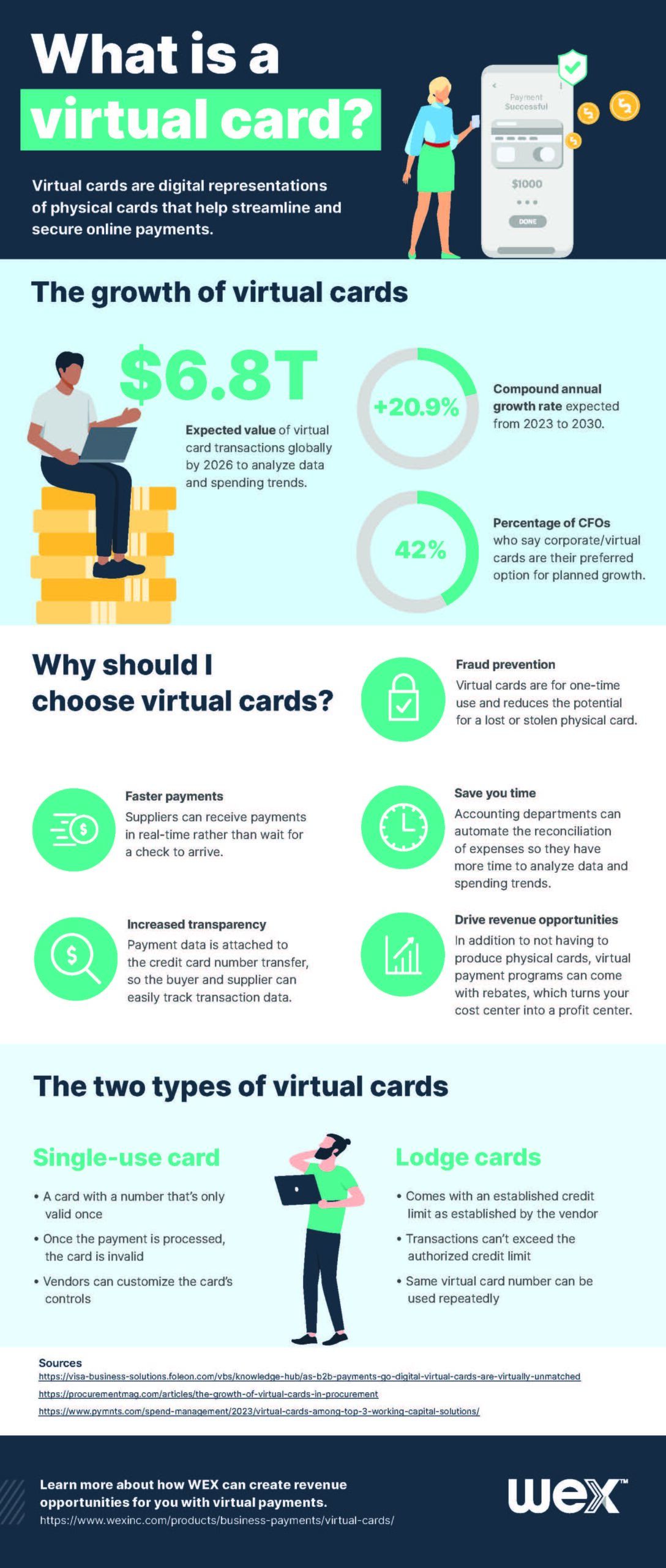

Check out the infographic below to learn more about virtual cards and why you should turn to them for your business payment needs!

For more insights and updates on corporate payments, check out:

Learn more about how WEX payment solutions can be tailored to your business, so you can accelerate and streamline operations while creating lasting growth and success for your organization.

Stay up to date on the latest in business payments by subscribing to our blog! Simply hit the “Subscribe” button above or submit your email address in the form below.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax, and investment advisers.

Editorial note: This article was originally published on February 8, 2021, and has been updated for this publication.

Subscribe to our corporate payments blog to stay on top of payment innovations.