Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

A dependent care flexible spending account (FSA) lets participants set aside pre-tax dollars to help pay for dependent care. Contributing to this benefit reduces taxable income and spreads the benefits of pre-tax dollars throughout the year, helping you save 30 percent or more (based on your tax rate) on your dependent care costs.

It’s a smart way to save money on expenses such as childcare or elderly care for a dependent. Watch the full podcast episode below or keep reading to learn more about these plans.

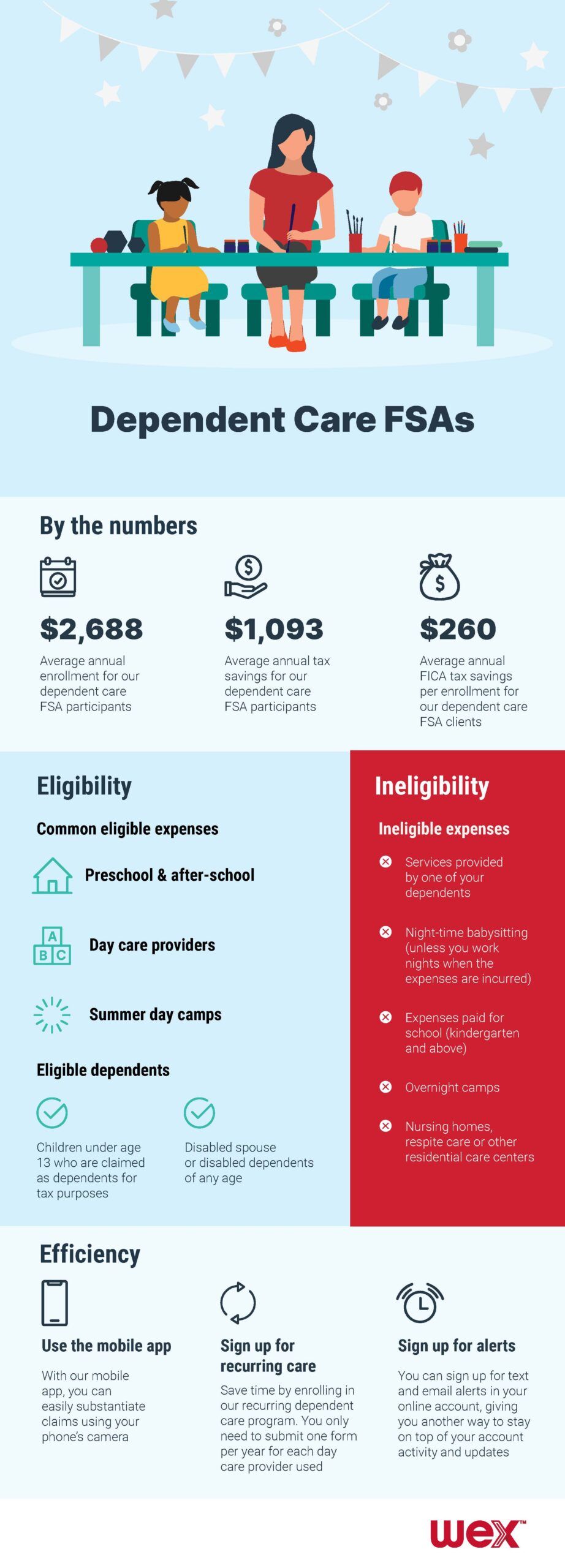

Funds can be used to pay for childcare for children under age 13 when they’re claimed as qualifying dependents. But the savings potential isn’t limited to just childcare. They can also cover care for a disabled spouse or dependent of any age.

To be eligible for dependent care FSAs when offered through your employer, you and your spouse (if applicable) must be employed, or your spouse must be a full-time student or looking for work.

Let’s say you enrolled and contributed $5,000 per year into a dependent care FSA in 2024. You also pay the average American tax rate of 24.8 percent. By putting that money aside pre-tax in a dependent care FSA rather than allowing the funds to be taxed, you save over $1,200 this year!

For married couples who file taxes separately, the 2025 limit is $2,500 per person per year.

Note: Employers may offer these limits, but are not required to.

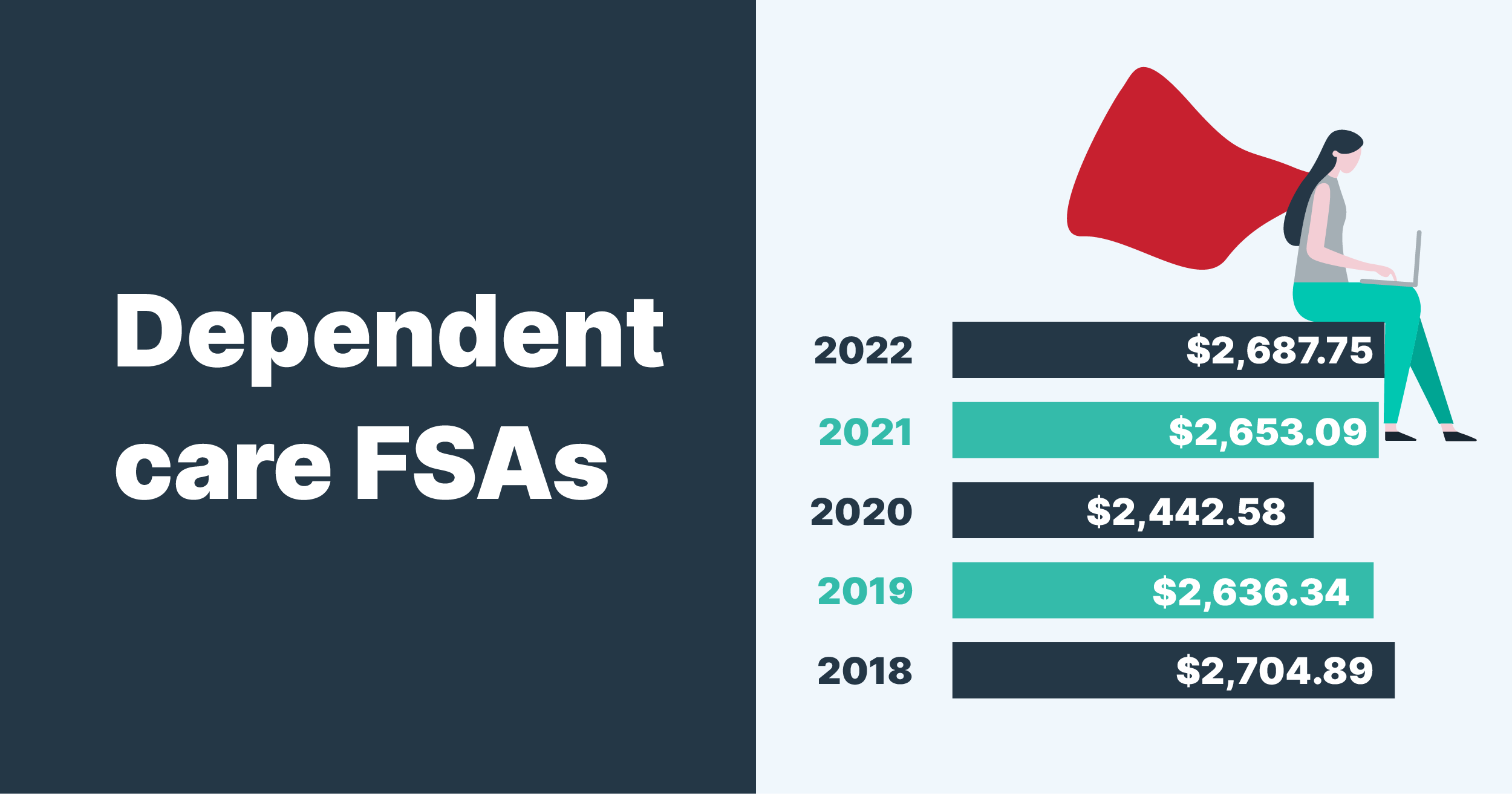

Below is a look at the average participant contribution to a dependent care FSA. For more benefit trends, click below!

Below is a look at the average participant contribution to a dependent care FSA. For more benefit trends, click below!

If you participate in a dependent care FSA by WEX, you have two easy options for collecting reimbursement with this type of FSA:

The IRS offers a tax credit to those who have childcare or dependent care expenses. You can’t enroll in a dependent care FSA and apply for the tax credit with the same funds. The tax credit is up to $6,000 per year for two or more children.

It’s possible to apply the tax credit to the difference of what you put into dependent care and the tax credit. For example, if you’re putting $5,000 into the account, that would leave $1,000 that you can apply the tax credit to before you’ve reached the $6,000 ceiling for the credit.

No, dependent care FSA funds do not carry over to the next plan year.

The dependent care FSA contribution limit for 2025 is $5,000 for individuals or married couples filing jointly ($2,500 for a married person filing separately).

Use our FSA calculator to see how FSAs can help you pay less taxes and increase your take-home pay.

You can use a dependent care FSA to pay for preschool, summer day camp, before or after school programs, and child or adult daycare.

Check out our graphic below to learn more about dependent care FSAs!

This blog post was most recently updated in February 2025.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.