Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

Only 16 percent of employers believe their employees are saving enough money for retirement. While many employers recognize this is an issue, determining the best solution has yielded a variety of different tactics.

One retirement-planning account that’s often overlooked is a health savings account (HSA). Only 7 percent of HSA participants invest their funds, even though an HSA has retirement-planning perks that a 401(k) and IRA don’t have. Keep reading to learn more, or download your free “HSAs and Why You Should Change the Retirement Strategy Story” white paper.

An HSA, 401(k), and IRA can all help employees save money when putting aside funds for retirement. All three accounts provide potential tax savings. And all three are also owned by the individual, meaning that the account stays with the employee whether they remain with their employer or not. That gives the employee peace of mind to lean on these accounts as part of their long-term strategy.

There are two important distinctions related to healthcare costs when comparing an HSA with a 401(k) and IRA:

1) Contributions and withdrawals

2) Surprise healthcare costs

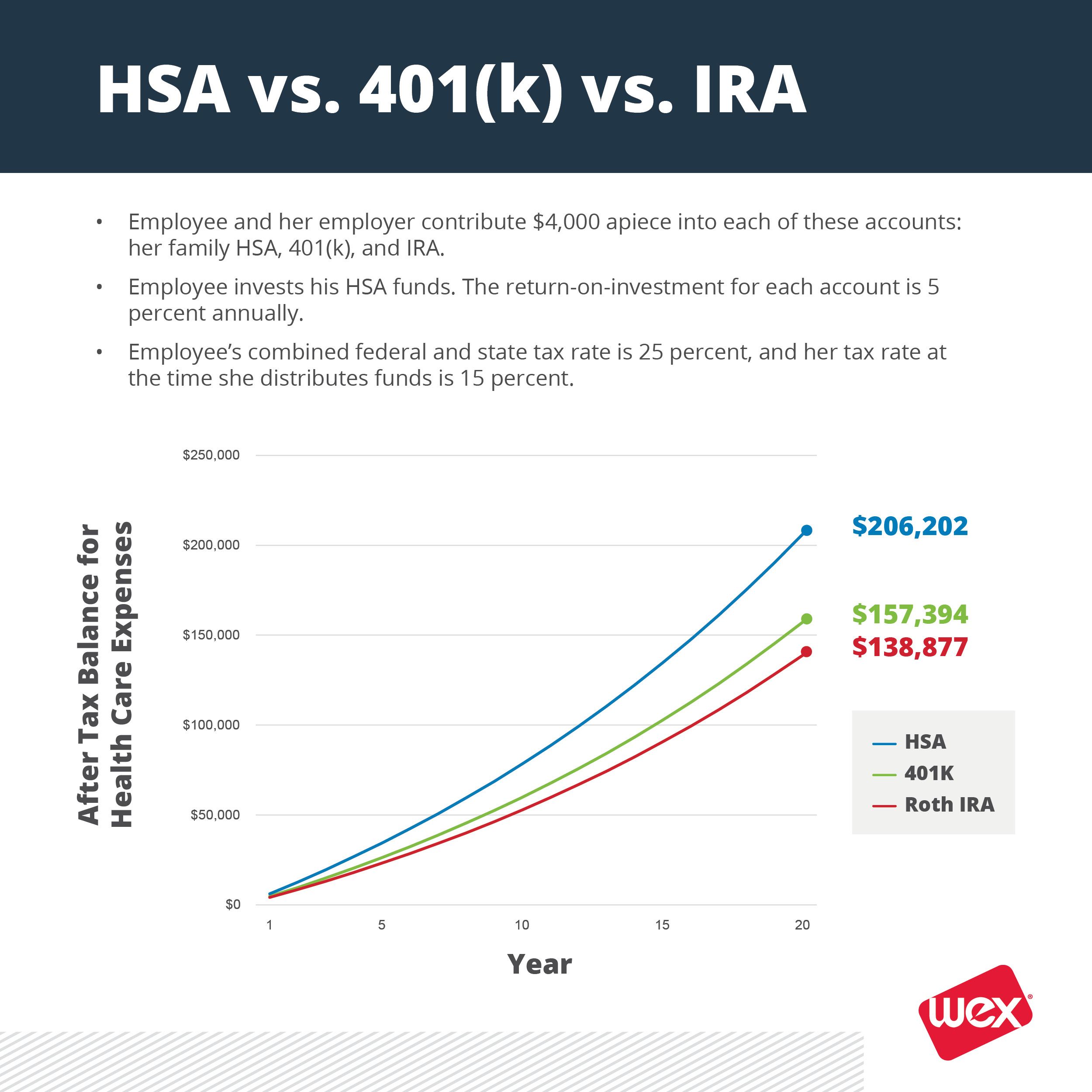

Let’s lay out a scenario for someone, who we’ll call Jane Smith. Jane is married with two kids and is preparing for retirement by participating in an HSA, 401(k), and IRA.

Watch her funds grow:

That’s a 31 percent increase in healthcare purchasing power with an HSA after 20 years when compared to a 401(k) or IRA! So what happened?

“Because of the triple-tax advantage nature of an HSA, employees actually make more money than with a 401(k) or IRA,” said Jeff Bakke, chief strategy officer for WEX’s health division. “There are other variables, such as employer matching of HSA or 401(k) funds that employees need to consider. But all things being equal, they’re actually better off putting money in an HSA.”

Would you like to learn more about HSAs and retirement planning? Get your free white paper.

Or would you like to learn more about how HSAs compare with a 401(k) and IRA? Watch our Benefits podcast episode below.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.