Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

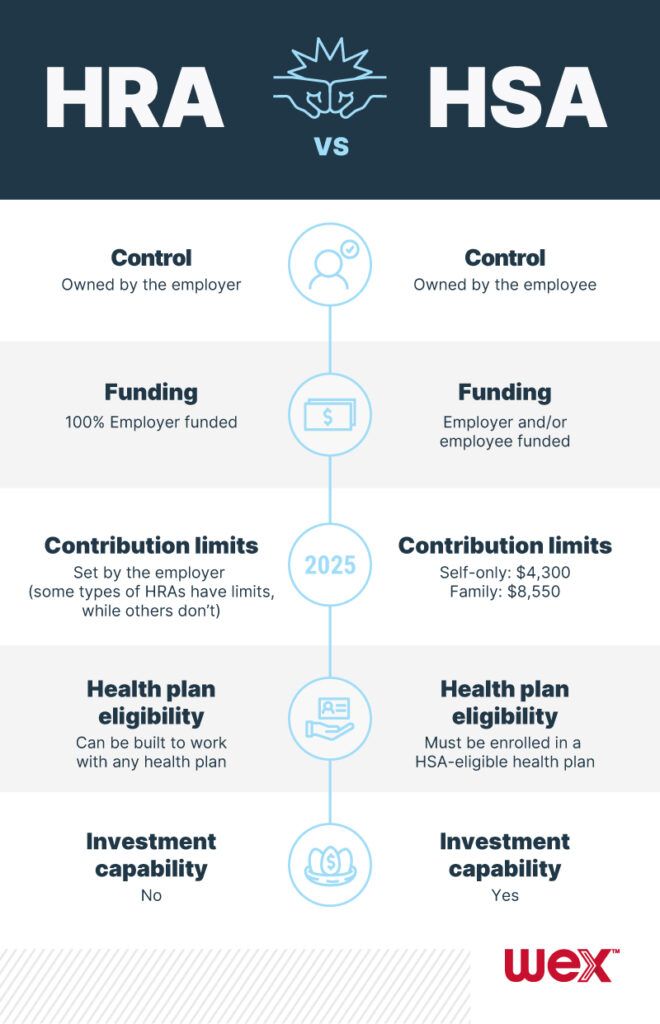

Health reimbursement arrangements (HRAs) and health savings accounts (HSAs) are great tools for you and your employees to save money, and for your employees to prepare for potential medical expenses. For employers, HRAs or HSAs come with perks, including tax savings and increased employee retention.

We’ve outlined the key differences between an HRA and an HSA below so you can see how they work, the advantages of each, and if you should be offering one or both to your employees.

An HRA is an employer-funded benefits plan that employees use to save pre-tax dollars on medical costs. HRAs provide flexibility for employers and employees because:

We support flexible plan designs, empowering you to determine your own benefits goals for your participants by letting you set up your HRA to look however you want.

An HSA is a participant-owned account funded by you and/or your employees. HSAs have a triple-tax advantage, as in general distributions for qualified medical expenses and investment returns are tax-free, and contributions are tax-deductible.

If you offer an HSA, you’ll save money on your payroll tax bill, while employees see financial gains in a number of ways, including:

Our HSA comes with a low-investment threshold, and our integrated investment experience through your employees’ benefits mobile app and online accounts make it easy for participants to make the most of their funds.

Watch our video below for seven things you should know about HSAs!

There are some differences in how funds carry over from one year to the next with an HRA versus an HSA. With an HSA, all funds carry over from one plan year to the next. With an HRA, the employer determines the amount of funds, if any, that carry over from year to year.

Contributions to an HRA by an employer can also be excluded from employees’ gross income. Also, employees do not pay federal income tax or employment taxes on contributions to the account. The employer has no maximum annual limit on how much they can contribute to an account.

Contributions to an HSA made by the employer generally can be excluded from employees’ gross income. The employee can also invest their HSA funds once their HSA balance reaches the HSA’s investment threshold.

Want to learn more about products we offer, such as an HRA vs. HSA? Simply hit the “Subscribe” button above or submit your email address in the form below.

This blog post was most recently updated in November 2024.

The information in this blog post is for educational purposes only. It is not legal,tax or investment advice. For legal, tax or investment advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.