Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

The 2022 health savings account (HSA) contribution limits have been announced by the IRS as part of Revenue Procedure 2021-25. The limits are:

| HSA | 2021 | 2022 |

| Self-only contribution limit | $3,600 | $3,650 |

| Family contribution limit | $7,200 | $7,300 |

The contribution limits for HSAs in 2022 will increase to $3,650 for single and $7,300 for family.

2022 high-deductible health plan (HDHP) amounts and expense limits were also announced.

| HDHP (self-only coverage) | 2021 | 2022 |

| Annual deductible not less than: | $1,400 | $1,400 |

| Annual out-of-pocket expenses don’t exceed: | $7,000 | $7,050 |

| HDHP (family coverage) | 2021 | 2022 |

| Annual deductible not less than: | $2,800 | $2,800 |

| Annual out-of-pocket expenses don’t exceed: | $14,000 | $14,100 |

The above limits means that an HDHP in 2022 is a health plan “with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses do not exceed $7,050 for self-only coverage or $14,100 for family coverage,” according to the IRS notice.

HSA participants who are 55 years of age or older can contribute an extra $1,000 annually. That means these HSA participants eligible for catch-up contributions have limits of $4,650 for self-only and $8,300 for family coverage.

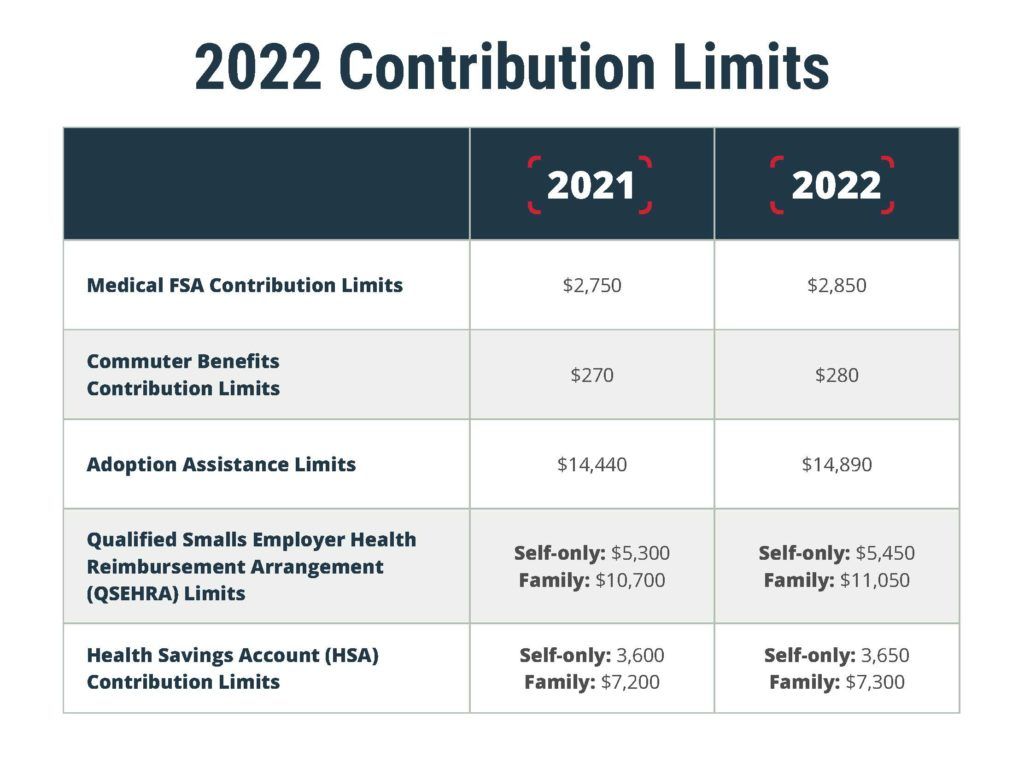

The IRS announces contribution limits for flexible spending accounts (FSAs), commuter benefits, and other plans as part of a separate release. Check out our graphic below for additional 2022 limits.

One of the perks of an HSA is that participants can change their contribution amount at any time!

Your employees must be enrolled in an HSA-eligible health plan (or HDHP) to be eligible to participate in an HSA. To learn more about why someone should enroll in an HSA, watch our video below:

Would you like to learn more about how HSAs can transform the retirement-planning experience? Get your free white paper.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.