Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

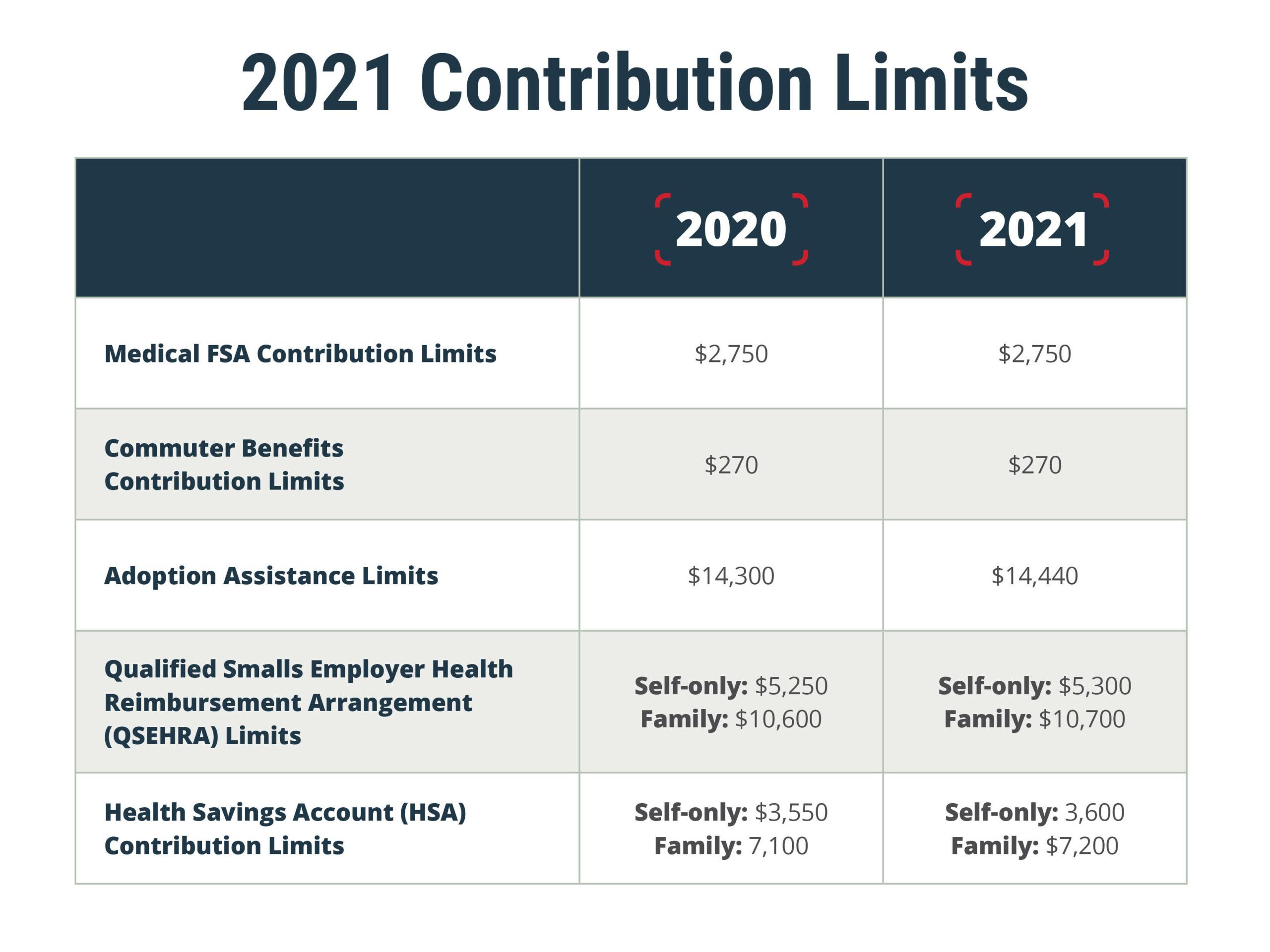

The IRS released 2021 contribution limits for medical flexible spending accounts (medical FSAs), commuter benefits, and more as part of Revenue Procedure 2020-45. The 2021 limits are:

| 2020 | 2021 |

| $2,750 | $2,750 |

The 2021 medical FSA contribution limit will be $2,750, which is the same amount as in 2020.

| 2020 | 2021 |

| $270 | $270 |

The monthly commuter benefits limit in 2021 for mass transit and parking remains at $270, which is unchanged from 2020.

| 2020 | 2021 |

| $14,300 | $14,440 |

The maximum amount that may be excluded from an employee’s gross income for the adoption of a special needs child through an adoption assistance program is $14,440 in 2021. That amount is the same as what may be excluded from that employee’s gross income for expenses incurred by an employer for qualified adoption expenses within the program.

| QSEHRA | 2020 | 2021 |

| Self-only | $5,250 | $5,300 |

| Family | $10,600 | $10,700 |

Employer contribution limits for QSEHRAs are $5,300 for self-only and $10,700 for families.

| HSA | 2020 | 2021 |

| Self-only | $3,550 | $3,600 |

| Family | $7,100 | $7,200 |

2021 HSA contribution limits were previously announced by the IRS. The limit is $3,600 for an individual and $7,200 for family.

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.