Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Increasingly, employers are offering a lifestyle spending account (LSA) as a way to support their employees’ wellness needs. Among our direct clients, we saw a 77% increase in clients offering an LSA in early 2022 year-over-year.

If you’re new to participating in an LSA, you may have questions about LSA definitions and rules. Here is a list of the top things a first-time LSA participant should be aware of in order to take full advantage of their LSA.

And don’t forget to check out our other first-timer series blog posts on:

An LSA is an employer-funded, post-tax spending account, with eligible expenses and plan details customized by your employer. An LSA is intended to promote healthy habits and overall well-being.

Since lifestyle spending accounts are entirely funded by your employer, you do not make an individual contribution to the account. Your employer decides the contribution amount each year. They also determine who is eligible to participate in the LSA, the contribution schedule, eligible expenses, and any rules around plan functionality. Your taxable income will increase if you spend funds from your LSA, but any unused funds will not be taxed.

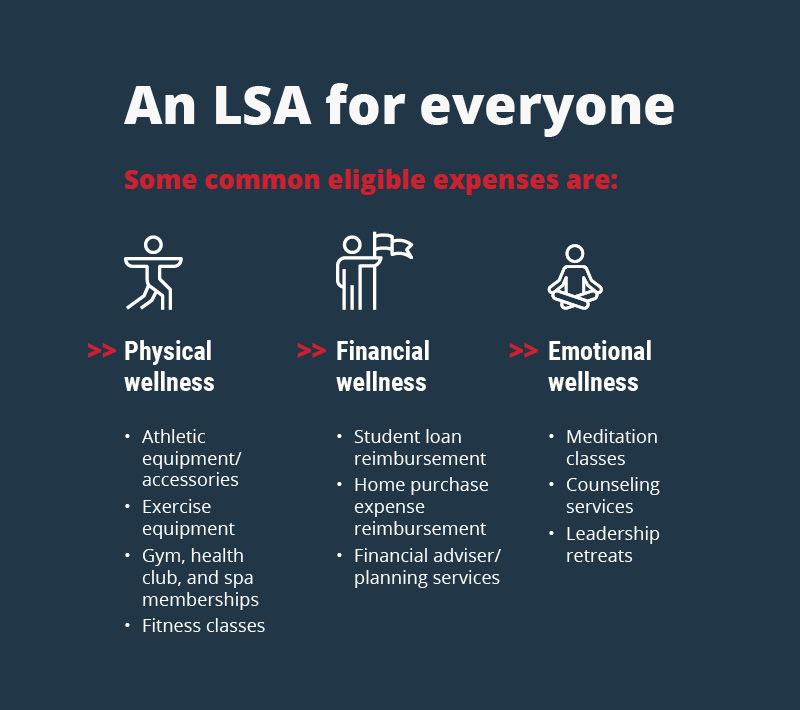

Your overall well-being should always be top of mind, but we often put our wellness needs aside because of financial or circumstantial reasons. A lifestyle spending account helps you put your wellness needs first by allowing you to save on a wide variety of physical, emotional, and financial wellness needs. An LSA provides value no matter what your interests or needs are, because of the wide variety of eligible expenses offered.

Unlike HSAs and FSAs that have specific IRS eligible expense requirements, your employer decides which eligible expenses to cover. Typically, your employer will customize the LSA eligible expense list to best fit their employees’ needs and lifestyles. Employees can offer eligible expenses that will encourage healthy habits, reduce financial stress, and promote learning opportunities.

Some of the most common physical, emotional, and financial wellness eligible expenses are:

With an LSA, your employer decides if it’s a reimbursement account. If it is, you’ll have to submit a claim for reimbursement through an online portal or mobile app after making a purchase. If it’s not a reimbursement account, your employer will provide you with a funded debit card that you’ll use for purchases.

Take a look at our infographic below to see more LSA eligible expenses:

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.