Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

How well are you supporting your employees with your benefits? With mental, physical, and financial wellness needs evolving quickly in the last couple years, you may need to adjust your benefits. With 1 in 4 Americans believed to have left their jobs in 2021, it’s worth noting that salary and benefits were the top two reasons cited for considering leaving a job in a recent survey.

Lifestyle spending accounts (LSAs) are a trendy way to support employee wellness needs. Since these are post-tax accounts, employers have a lot of control over how they look. Interested in providing one? We’ve compiled a few common questions we ask employers when designing an LSA. Or watch our episode of Benefits, where we dive into common LSA plan design questions.

When providing a new benefit, it’s important to have a clear understanding of what your goals are for the benefit. In the case of LSAs, are you hoping to support employee mental health? Or boost employee retention rates? You’ll also want to think about what behaviors you’re trying to encourage from your employees with your LSA.

“Right now, there is such a need for employers to retain their employees and attract more talent into their organization,” said Arika Palloch, Vice President, Sales Consulting at WEX Benefits Division on our Benefits podcast. “LSAs are a great way to meet those needs because they’re a way to enhance the benefits employers are offering in a unique way and show existing employees they’re highly valued.”

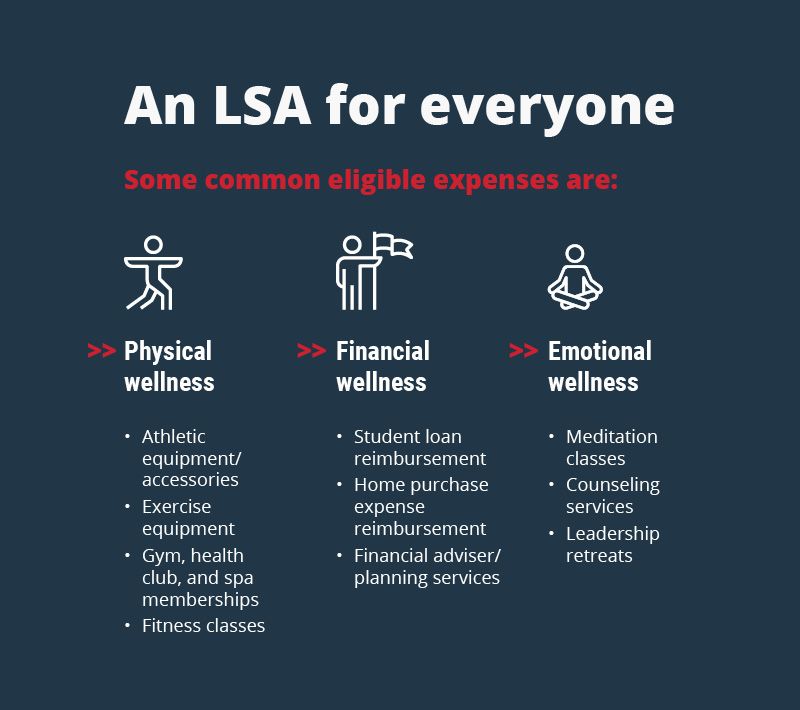

LSA eligible expenses are completely customizable by the employer. What problems you’re trying to solve for and what employee behaviors you’re trying to influence will help drive the LSA’s eligible expenses. Our standard LSA offering includes athletic equipment, student loan reimbursement, meditation classes, and counseling services as eligible expenses.

“LSAs give employees the freedom of choice and more options because of how they’re structured,” said Palloch. “Typically with an LSA there’s a broad list of what’s eligible, so employees can choose what’s going to work best for themselves and their family versus a traditional plan which is highly regulated and has a smaller list of what’s eligible.”

Drive wellness

that works

Get your guide.

You can also determine when employees will receive their funds. Your options include at the start of a plan year, periodically throughout the plan year, or tied to a behavior.

The most common contribution schedules for employers with a WEX LSA are:

How much do you have in your benefits budget to fund employees’ LSAs? Planning your LSA budget is easier when funds are provided to employees in a consistent way (such as everyone receiving the same amount at the beginning of the plan year). If you are using your LSA to drive a certain behavior (such as physical activity), that does create a variable.

With an LSA, whether or not your employees need to submit documentation for their LSA claims is up to you. You could create a process like what flexible spending account (FSA) participants use when they submit for reimbursement of FSA claims, or you could not require LSA substantiation at all.

If you’re currently providing any sort of funding for mental, physical, and financial wellness, you may want to wrap that benefit or benefits into your LSA. That way your employees view their LSA as their one-stop shop for any of these types of expenses. Considering what population(s) of employees are currently enrolled in these similar benefits and how much are employees participating in them.

The class or classes of employees eligible to be covered by your LSA is also customizable. You can decide if you will provide an LSA to all benefits-eligible employees or if it will only be available to a specific class or subset of employees.

Check out our infographic to learn about some common LSA eligible expenses:

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own counsel.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.