Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Whether you’re transitioning from your parents’ insurance, landed your first full-time job, or are simply obtaining coverage for the first time, choosing health plans and employee benefits options can be overwhelming. You’ll likely hear a lot of terms and acronyms that you’ve never heard before. For first-time health insurance and benefits electees, we’re kicking off a three-part blog series just for you to walk through considerations when making these decisions. For starters, let’s look at a few considerations when evaluating health plans for the first time.

And check out our Benefits Buzz podcast episode below with Adam Dellaneva, customer service business partner, below.

Understanding your annual healthcare expenses is a fundamental step in selecting the right health plan. Consider whether you typically have low or high medical expenses. If you rarely require medical care and prefer to save on monthly premiums, a plan with a higher deductible and lower premiums might be suitable. On the other hand, if you anticipate regular medical visits, chronic conditions, or potential emergencies, a plan with lower deductibles and higher premiums may offer better cost protections.

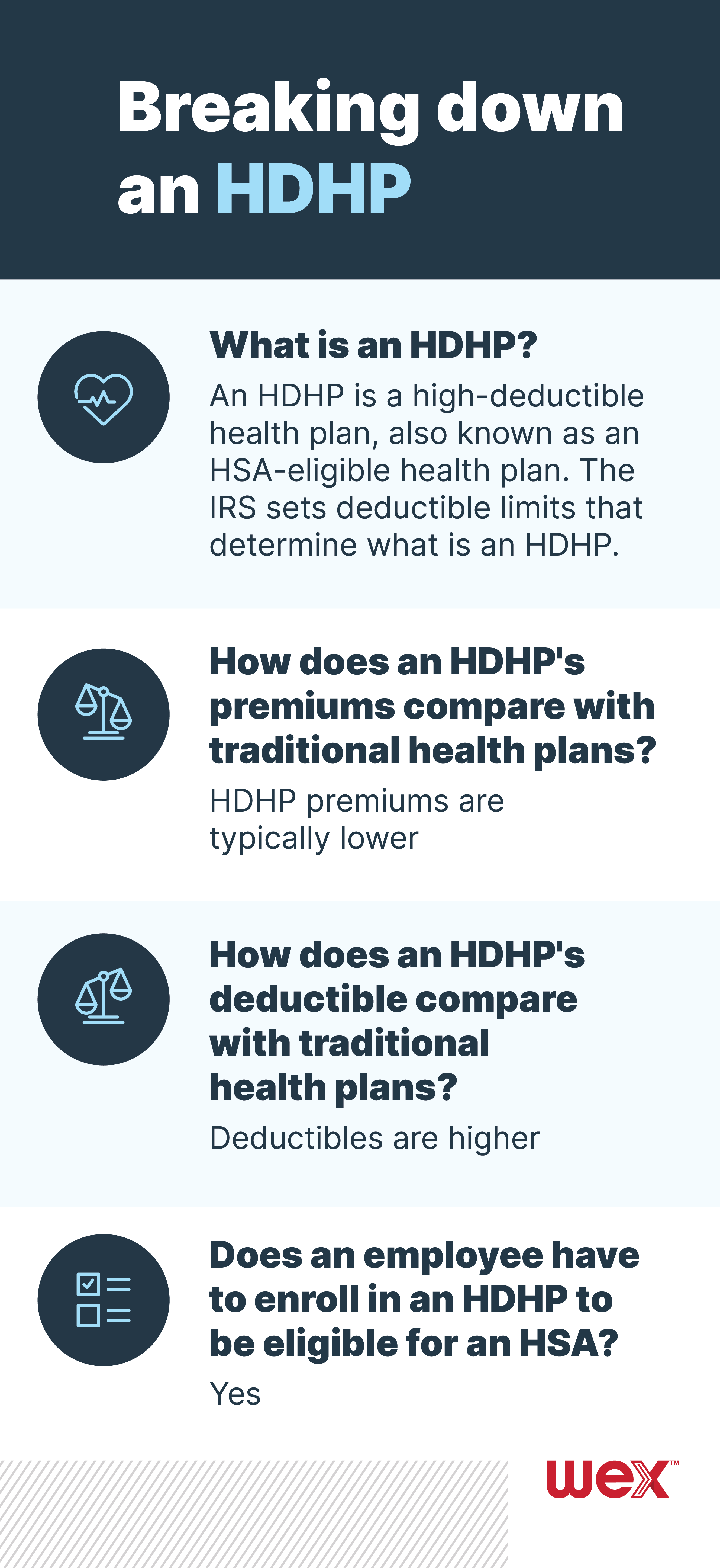

Learn more about HSA-eligible health plans (or high-deductible health plans) in our graphic below.

Identifying the benefits you value most is another crucial aspect of selecting a health plan. Think about your healthcare priorities, such as prescription medications, specialist visits, mental health services, or maternity coverage. Some plans may offer more comprehensive coverage in these areas, while others might focus on essential services. Make a list of the benefits that matter most to you, and use it as a guide when comparing different health plans.

To make an informed decision, it’s essential to understand various medical plans and how they relate to your life. Let’s explore some common options:

Health savings accounts (HSAs) and flexible spending accounts (FSAs) are among the pre-tax accounts you can contribute funds to and save money on healthcare costs. However, your eligibility for either account can be influenced by the health plan you choose.

If HSA and FSA participation will play a big role in your health plan decision, check out this blog post to learn more about the differences between the two accounts.

In addition to premiums, it’s crucial to evaluate the cost-sharing and out-of-pocket expenses associated with each health plan. Look at factors such as copays, coinsurance, and deductibles. Copays are fixed amounts you pay for each medical service, while coinsurance is a percentage of the cost you share with the insurance company. Deductibles are the amount you must pay before your insurance coverage kicks in. Compare these elements across different plans to assess their impact on your budget.

Don’t hesitate to seek guidance from healthcare professionals or insurance experts who can offer valuable insights and advice. Additionally, take advantage of online resources and tools provided by WEX! These resources include plan comparison tools, cost calculators, and coverage explanations to help you make an informed decision.

Be mindful of health insurance enrollment periods. If you have recently turned 26 or experienced another qualifying life event, you may be eligible for a special enrollment period.

Subscribe to our blog to stay updated on all the benefits information you need!

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.