Stay connected

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.

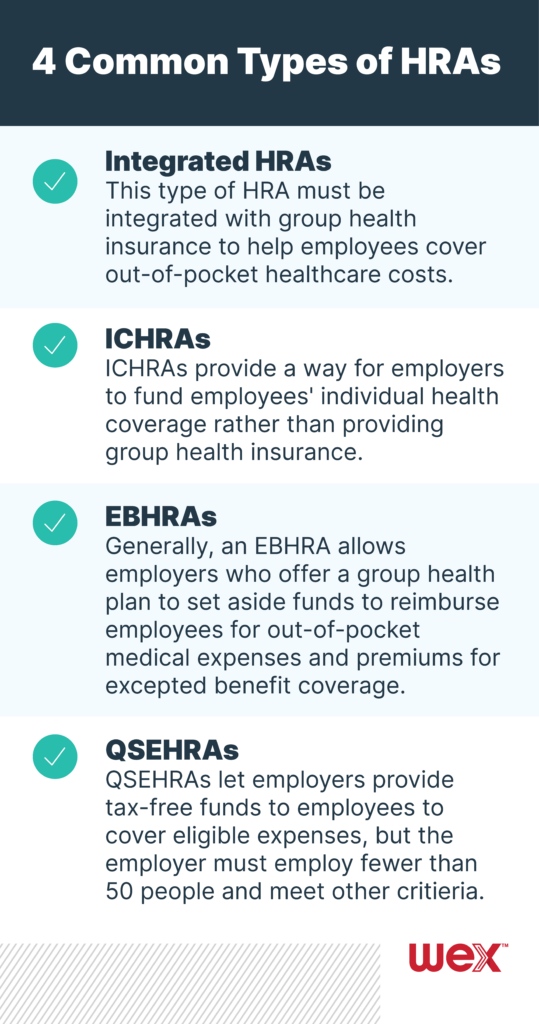

Health reimbursement arrangements (HRAs) are an employee benefits staple. But they’ve also evolved in recent years, with three increasingly popular types of HRAs rolled out since 2017. While you can customize an HRA based on the needs of your business and your employees, there are a few types that are frequently offered. We break down four common types of HRAs.

As the name suggests, this type of HRA must be integrated with group health insurance to help employees cover out-of-pocket healthcare costs, meaning employees must be enrolled in the group health insurance to enroll in the HRA. You can customize this HRA in a number of ways, including through its eligible expenses, such as with:

You can also customize this HRA by including threshold amounts. Once your employees reach an initial amount (or threshold) in expenses, your HRA will pay for eligible expenses until the employee reaches the deductible for their health plan. With a threshold HRA, you determine what the out-of-pocket threshold is and can choose different amounts for single and family enrollments. For example, your contribution to your employees’ HRA can be $2,000 for a single enrollment and $4,000 for a family enrollment. You could require the single enrollees and family enrollees meet out-of-pocket thresholds of $1,000 and $2,000, respectively, before being able to access HRA funds.

The individual coverage HRA (ICHRA) was first introduced in 2020. Employers can offer ICHRAs as a way to fund their employees’ individual health coverage rather than providing group health insurance (ICHRAs can’t be offered with group health insurance to the same class of employees). To be eligible, employees must be enrolled in individual health insurance or Medicare Parts A, B or C coverage. Employees can’t be covered by a healthcare sharing ministry plan or by a spouse’s group health insurance to enroll.

Employers may design the plan to reimburse premiums and 213(d) eligible expenses, or an ICHRA can cover only premiums. When introduced, it was expected that an estimated 800,000 employers were expected to offer ICHRAs to more than 11 million employees and family members.

An excepted benefit HRA (EBHRA), like an ICHRA, was introduced in 2020. For 2024 plan years, an EBHRA allows employers who offer a group health plan to set aside up to $2,100 per year per employee to reimburse employees for out-of-pocket medical expenses and premiums for excepted benefit coverage, which includes dental coverage, vision coverage, COBRA premiums and short-term limited duration insurance (but excluding individual health insurance premiums).

Any employee that is offered the group health plan is eligible to participate in an EBHRA, whether or not they’re enrolled in your group health plan.

A qualified small employer health reimbursement arrangement (QSEHRA) lets you provide tax-free funds to your employees to cover eligible expenses, but it’s only available to you if you employ fewer than 50 people and meet certain other criteria. QSEHRAs are an option for employers who are looking for ways to help their employees with healthcare costs in lieu of offering group health insurance. In fact, QSEHRAs can’t be offered if you offer a group health plan.

Stay on top of HRAs and other employee benefits by subscribing to our blog.

Subscribe to our health benefits blog and follow us on social media to receive all our health benefits industry insights.