Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

Beginning in tax year 2011, businesses received a break from the IRS. This wasn’t a tax break per se, but it did reduce the amount of time that some organizations spent compiling and reporting purchases of goods and services to suppliers. What does this mean for travel agents, travel management companies, OTAs, tour operators, and more?

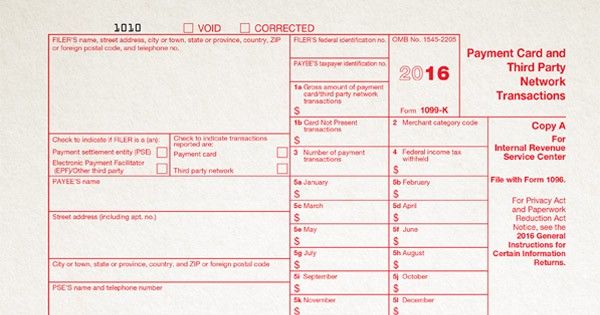

The 1099-K Reporting Requirements for Payment Settlement Entities shifted the responsibility of reporting from the purchaser to the payment settlement entity (merchant acquiring entities and third party settlement organizations) for all credit card and purchasing card (p-card) transactions. Part of the Housing Assistance Tax Act of 2008, this saves hours for purchasing organizations who would otherwise need to consolidate, reconcile, and report accounts payable transactions.

See below the background, the terminology, and how use of payment cards shift reporting to suppliers and the IRS away from your organization.

Under section 6050W of the Internal Revenue Code, payment settlement entities (merchant acquiring entities and third party settlement organizations) must report payment card and third party network transactions.

This reporting requirement began in early 2012 for payment card and third party network transactions that occurred in 2011.

A payment settlement entity is an entity that makes payment in settlement of a payment card transaction or third party network transaction. Payment Settlement Entities are often referred to as “PSEs” and can take one of two forms:

All instructions can be found here: 2016 Instructions for Form 1099-K, the form itself can be found here: Form 1099-K, and information for Payees, Payment Settlement Entities, and Payers can be found here: 1099-K FAQ

For travel agents, tour operators, flash sale companies, or any of the like, you could have hundreds, if not thousands of suppliers to whom you are sending 1099s in this coming January. All of this, in turn is sent to the IRS.

If you transition completely to use of a purchasing card in order to pay your suppliers, said suppliers will receive 1099-K from the bank or credit card company in charge of the payment, and all reporting to the IRS will be taken care of by the payment settlement entity—saving you time, money, and risk.

By transitioning to a purchasing card, you can save time and money when taxes come due. But the move to a virtual card saves you all year long.

For more information on how a virtual card can do all this and more while integrating into your current processes and systems, read Into the Light: The Way to Better Travel Reconciliations and Book Smarter with Virtual Cards.

For even more, learn the three reasons that virtual cards will become the leading option for corporate travel payments in 2016.

WEX Travel has helped the largest OTAs simplify payments, but is suited to help travel organizers of any size to automate reconciliations, reduce risk, save time, and simplify payments. See how it works, and contact us to learn more.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.