Stay connected

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.

High-deductible health plans (HDHPs) have become increasingly popular over the last few years by offering unique features and benefits that appeal to many individuals and families. However, navigating the complexities can be daunting, so let’s break it down.

An HDHP is a type of health plan characterized by its higher deductibles and typically lower premiums compared to traditional health plans. The deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance plan begins to pay.

Similar to other health plans, once you meet the deductible, insurance begins to cover a portion of medical expenses. The remaining portion, known as coinsurance, becomes your responsibility until you reach your out-of-pocket maximum.

An HDHP provides coverage for a wide range of medical expenses. This can include:

As the name suggests, HDHPs come with a high deductible. This means that you’ll have to pay a significant amount out-of-pocket for healthcare services before your insurance coverage kicks in. This amount can vary depending on the specific plan.

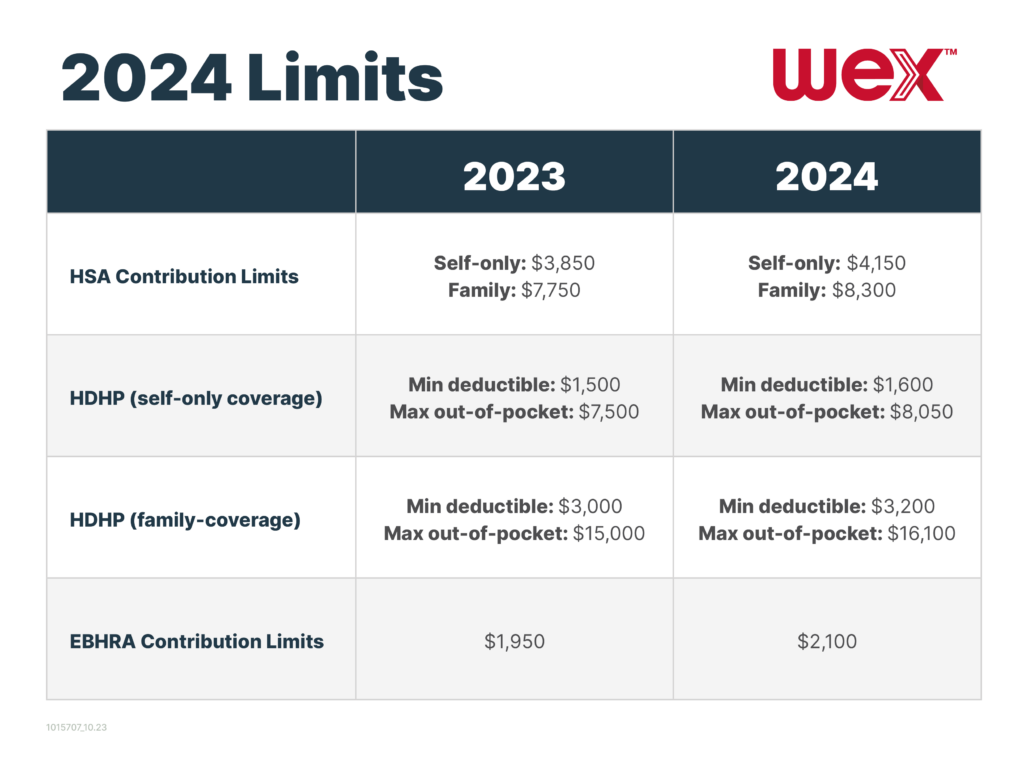

HDHPs have limits for allowable deductible amounts and out-of-pocket costs.

Opting for a high deductible in an HDHP comes with the benefit of reduced monthly premiums. Generally, HDHPs have lower premiums compared to others. This can make HDHPs a great option for saving on monthly payments.

Another great perk of HDHPs is they can be paired with health savings accounts (HSAs). An HSA is a tax-advantaged savings account that allows you to save money specifically for medical expenses. Contributions to an HSA are tax-deductible, and funds can be used to pay for qualified medical expenses including:

Individuals must be covered by an HDHP to be eligible for an HSA.

Depending on healthcare needs and financial circumstances, an HDHP can be a suitable option. Here are some examples:

If you’re in general good health and don’t anticipate needing frequent medical care, an HDHP with its lower premiums could be a cost-effective choice.

Pairing an HDHP with an HSA allows you to save for future medical expenses while benefiting from tax advantages.

Families with minimal health care needs may find HDHPs appealing due to their lower premiums, especially if they have sufficient savings to cover potential medical expenses before their deductible is met.

See our HDHP/HSA vs. Traditional health plan calculator to see which plan is right for you.

The information in this blog post is for educational purposes only. It is not legal or tax advice. For legal or tax advice, you should consult your own legal counsel, tax and investment advisers.

WEX receives compensation from some of the merchants identified in its blog posts. By linking to these products, WEX is not endorsing these products.

Subscribe to our Inside WEX blog and follow us on social media for the insider view on everything WEX, from payments innovation to what it means to be a WEXer.